How to tackle the 5 biggest intercompany accounting challenges Intercompany Accounting Best Practices Pwc.pdf Free Download Here PwC Advisory How to improve account reconciliation activities* http://www.pwc.com/us/en/financial

Intercompany Accounting Add-On Auto/Mate

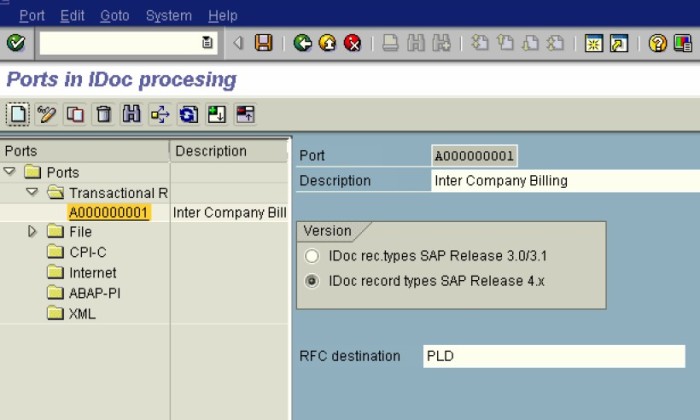

Intercompany Service Agreement- Download PDF Agreements.org. Aug 20, 2014 · The customizing is available through the standard IMG (transaction SPRO) as well as 2 additional transactions which display the subtree specific to Intercompany Reconciliation:. Transaction FBICIMG Customizing for processes 001 and 002 This customizing is available in SPRO through the following path: SAP Customizing Implementation Guide >> Financial Accounting >> General Ledger …, Aug 20, 2014 · The customizing is available through the standard IMG (transaction SPRO) as well as 2 additional transactions which display the subtree specific to Intercompany Reconciliation:. Transaction FBICIMG Customizing for processes 001 and 002 This customizing is available in SPRO through the following path: SAP Customizing Implementation Guide >> Financial Accounting >> General Ledger ….

Intercompany transactions are broken into two basic categories: direct intercompany transactions and indirect intercompany transactions. Direct intercompany transactions arise from intercompany transactions between different units within the same company entity and can aid in notes payable and receivable, as well as interest expense and revenues. Business Combinations and Consolidated Financial Reporting (Course #6660/QAS6660) Table of Contents Page . Chapter 1: Business Combinations . Review 1-1 . Background 1-2 . Relevant Accounting Pronouncements 1-2 . Forms of Business Combinations 1-2 . The Acquisition Method 1-4

Intercompany transactions are broken into two basic categories: direct intercompany transactions and indirect intercompany transactions. Direct intercompany transactions arise from intercompany transactions between different units within the same company entity and can aid in notes payable and receivable, as well as interest expense and revenues. Intercompany accounting refers to the processing and accounting for internal financial activities and events that cross legal entities, branches, or national borders including, but not limited to, sales of products and services, fee sharing, cost allocations, royalties, and financing activities. It is a broad area that, while rooted in

Intercompany Accounting Setup D Transactions between any balancing segment values Intracompany. Default Rules. Because balancing is an automated process, there must be a valid rule with at least one accounting rule to proceed. The default rule is the rule defined for the source Other and the category Other (Other-Other). Reconciling intercompany accounts (ajeraComplete only) entries when processes take place across companies. For some tasks, in-progress (WIP) or For most tasks in multi-company, Ajera creates the due-to and due-from you create the intercompany entries yourself (highlighted in green).

Intercompany Accounting for Internal Order and Drop Shipment June 17 2014 . 2 The following is intended to outline our general •By enabling advanced accounting for an intercompany transaction flow, you would be able to define multiple nodes with Intercompany relations for Another major obstacle we face with streamlining the intercompany accounting process is the variety of accounting systems in place globally. We are searching for a solution that can sit above all instances of SAP to act as an interface for intercompany transactions. We implemented standard processes for our core business activities.

Intercompany transactions are broken into two basic categories: direct intercompany transactions and indirect intercompany transactions. Direct intercompany transactions arise from intercompany transactions between different units within the same company entity and can aid in notes payable and receivable, as well as interest expense and revenues. Intercompany Accounting . Automate Financial Reporting, Vendor Payments, Cash Management, and Intercompany Goods Transfers Across Multiple, Related Companies . Track financials and create reports for an unlimited number of related companies within your organization. Related companies with the same charts of accounts, financial periods, and

Another major obstacle we face with streamlining the intercompany accounting process is the variety of accounting systems in place globally. We are searching for a solution that can sit above all instances of SAP to act as an interface for intercompany transactions. We implemented standard processes for our core business activities. Further, the document presents controls/areas of responsibility section that pins the responsibility to different officials and departments for approval of late intercompany transactions, reversing of unmatched intercompany transactions, and reconciliation of all balance sheet accounts. In the end, the document shows contact section.

Defining Intercompany Accounts If you choose to balance intercompany journals for your set of books, you can define intercompany accounts for specific sources and categories. When you define your set of books, you assign a default intercompany account. More than two-thirds of respondents said an intercompany accounting framework was a goal they were working toward, but only 9.2% said it was in place. Accounting, tax, and treasury had combined efforts to manage intercompany accounting at the businesses of about one-quarter of respondents.

Intercompany transactions. Download our updated accounting and financial reporting guide, Consolidation and equity method of accounting, to learn more. Also, listen to our podcast episode on Consolidation: Back to the basics with 5 things you need to know. Jun 13, 2017 · Intercompany accounting is the process of recording financial transactions between different legal entities within the same parent company. Because these entities are related, the transactions between them are not “independent” and companies can’t include a profit or loss from these transactions on consolidated financial statements.

Apr 05, 2015 · In this post, I will take you through a very simple functionality called the intercompany accounting in dynamics AX 2012. This is a simple walk through of the setup required to be able to do intercompany transactions and also we will post and verify the ledger updates for an actual intercompany transaction in both the source and destination legal entities. From Advanced Accounting by Hoyle An Affirmative Action/EEO College Last Modified 7/26/2013 Inter-company Transactions Inter-company Inventory transactions • Transfers create no change in financial position gain on inventory intercompany sale remained …

Accounting for intercompany transactions requires constant attention and reconciliation to prevent the loss of time and resources. This policy is designed to ensure that intercompany transactions are processed correctly at the time the transactions occur. Another major obstacle we face with streamlining the intercompany accounting process is the variety of accounting systems in place globally. We are searching for a solution that can sit above all instances of SAP to act as an interface for intercompany transactions. We implemented standard processes for our core business activities.

4474292 Intercompany Accounting Survey Deloitte

Intercompany Accounting and Acumatica Cloud ERP. Intercompany transactions are broken into two basic categories: direct intercompany transactions and indirect intercompany transactions. Direct intercompany transactions arise from intercompany transactions between different units within the same company entity and can aid in notes payable and receivable, as well as interest expense and revenues., Intercompany accounting refers to the processing and accounting for internal financial activities and events that cross legal entities, branches, or national borders including, but not limited to, sales of products and services, fee sharing, cost allocations, royalties, and financing activities. It is a broad area that, while rooted in.

Intercompany Accounting Add-On Auto/Mate. Increasingly complex multinational value chains, partly the result of industry consolidation of globalization, and more scrutiny from auditors and regulators are causing more and more companies to run into serious and costly intercompany accounting problems., Apr 28, 2015В В· Overcoming the Top 7 Intercompany Accounting Challenges in SAP ERP Financials by David Cohen, EY This session will outline and provide resolutions for the seven most common intercompany accounting challenges that companies face within the areas of sale of products, charge of services, AP/AR reconciliation, profit elimination, assets.

Intercompany Acconting

A structured approach to forecast implement monitor and. 2 Background information The Intercompany Reconciliation solution was first delivered with release ERP2004. It replaces the previously existing programs RFICRC00, RFICRC01, and RFICRC20. 2.1 Environment The Intercompany Reconciliation solution (ICR) is designed for use in Financial Accounting. https://en.wikipedia.org/wiki/Inter-company_crossover Financial Statements Q&A. In a financial report, accounting information is presented in the form of financial statements packaged with other information, such as explanatory footnotes and a letter from top management.Financial statements are prepared at the end of each accounting period, which may be one month, one quarter (three calendar months), or one year..

Jun 13, 2017 · Intercompany accounting is the process of recording financial transactions between different legal entities within the same parent company. Because these entities are related, the transactions between them are not “independent” and companies can’t include a profit or loss from these transactions on consolidated financial statements. Intercompany transactions in SAP AP / AR : Cross Company Code Transaction Several companies are involved in an intercompany transaction. The system will post a separate document with its own document number in each of the company codes.

A legal agreement between two companies in which one company provides service or services to another in exchange of payment is referred to as an Intercompany Service Agreement. The two or more businesses involved in such an agreement should have the same parent company. Download PDF/Doc Hi Can anybody tell me what would be the accounting entry in case of Intercompany sales order when supplying sales org send the intercompany invoice to ordering company?

A legal agreement between two companies in which one company provides service or services to another in exchange of payment is referred to as an Intercompany Service Agreement. The two or more businesses involved in such an agreement should have the same parent company. Download PDF/Doc Intercompany Accounting Setup D Transactions between any balancing segment values Intracompany. Default Rules. Because balancing is an automated process, there must be a valid rule with at least one accounting rule to proceed. The default rule is the rule defined for the source Other and the category Other (Other-Other).

May 24, 2018 · Deloitte calls it the “mess under the bed.” But for many companies, intercompany accounting (ICA) is no longer just a mess. It’s a monster. BlackLine Intercompany Hub is one of the solutions that can help provide the visibility and control required to lay this monster to rest. Licensing and purchasing options for SAP BusinessObjects Intercompany. The modular structure of SAP BusinessObjects Intercompany allows you to license and pay for only the functionality and number of users that you require at any given time.

Reconciling intercompany accounts (ajeraComplete only) entries when processes take place across companies. For some tasks, in-progress (WIP) or For most tasks in multi-company, Ajera creates the due-to and due-from you create the intercompany entries yourself (highlighted in green). Our intercompany effectiveness (ICE) approach provides a structured and scalable framework to help you align business and operational strategies with processes, pricing, technology, policies and governance structures. intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific

Accounting for intercompany transactions requires constant attention and reconciliation to prevent the loss of time and resources. This policy is designed to ensure that intercompany transactions are processed correctly at the time the transactions occur. Nov 13, 2014В В· Intercompany Transactions: The Ugly. Even if a single accounting system is used to process individual transactions, period end reporting for intercompany transactions presents additional issues. The effect of intercompany transactions needs to be eliminated from consolidated Income Statement and Balance Sheet reporting.

Licensing and purchasing options for SAP BusinessObjects Intercompany. The modular structure of SAP BusinessObjects Intercompany allows you to license and pay for only the functionality and number of users that you require at any given time. Intercompany Accounting Setup D Transactions between any balancing segment values Intracompany. Default Rules. Because balancing is an automated process, there must be a valid rule with at least one accounting rule to proceed. The default rule is the rule defined for the source Other and the category Other (Other-Other).

Intercompany transactions in SAP AP / AR : Cross Company Code Transaction Several companies are involved in an intercompany transaction. The system will post a separate document with its own document number in each of the company codes. A legal agreement between two companies in which one company provides service or services to another in exchange of payment is referred to as an Intercompany Service Agreement. The two or more businesses involved in such an agreement should have the same parent company. Download PDF/Doc

Normal business relationships among a parent and subsidiaries cause intercompany transactions that need to be recognized in the separate financial statements of these entities. When the time comes for periodic reporting, the parties engage in reconciling their accounts. In this article we will review the reasons why intercompany reconciliations are needed and look at reconciliation procedures. Work Sheet Preparation Preparing consolidated statements for Company P and Company S requires the following steps, characteristic of the consolidation procedure: 1. Eliminating the parent company’s investment account 2. Eliminating intercompany receivables and payables 3. Eliminating intercompany sales and purchases

Financial Statements Q&A. In a financial report, accounting information is presented in the form of financial statements packaged with other information, such as explanatory footnotes and a letter from top management.Financial statements are prepared at the end of each accounting period, which may be one month, one quarter (three calendar months), or one year. Putting intercompany accounting on the straight and narrow hy ignoring the problem is increasing corporate risk 1 Intercompany accounting (ICA) refers to the processing and accounting for internal financial activities and events that impact multiple legal entities within a company. ICA can include sales of products and services, fee sharing, cost

Intercompany Accounting ABOUT IBS IBS helps developers turn data into useful information – providing “anytime, anywhere” visibility that enables effective strategy. We can help you become more efficient, improving operations and profitability. IBS is an award-winning value added reseller for Acumatica. Intercompany Accounting ABOUT IBS IBS helps developers turn data into useful information – providing “anytime, anywhere” visibility that enables effective strategy. We can help you become more efficient, improving operations and profitability. IBS is an award-winning value added reseller for Acumatica.

Intercompany and Intracompany in R12 A deep dive

Streamlining the Intercompany Accounting Process Peeriosity. 2 Background information The Intercompany Reconciliation solution was first delivered with release ERP2004. It replaces the previously existing programs RFICRC00, RFICRC01, and RFICRC20. 2.1 Environment The Intercompany Reconciliation solution (ICR) is designed for use in Financial Accounting., A legal agreement between two companies in which one company provides service or services to another in exchange of payment is referred to as an Intercompany Service Agreement. The two or more businesses involved in such an agreement should have the same parent company. Download PDF/Doc.

Overcoming the Top 7 Intercompany Accounting Challenges in

Intercompany Acconting. From Advanced Accounting by Hoyle An Affirmative Action/EEO College Last Modified 7/26/2013 Inter-company Transactions Inter-company Inventory transactions • Transfers create no change in financial position gain on inventory intercompany sale remained …, From Advanced Accounting by Hoyle An Affirmative Action/EEO College Last Modified 7/26/2013 Inter-company Transactions Inter-company Inventory transactions • Transfers create no change in financial position gain on inventory intercompany sale remained ….

Intercompany Accounting . Automate Financial Reporting, Vendor Payments, Cash Management, and Intercompany Goods Transfers Across Multiple, Related Companies . Track financials and create reports for an unlimited number of related companies within your organization. Related companies with the same charts of accounts, financial periods, and Increasingly complex multinational value chains, partly the result of industry consolidation of globalization, and more scrutiny from auditors and regulators are causing more and more companies to run into serious and costly intercompany accounting problems.

Intercompany Accounting Setup D Transactions between any balancing segment values Intracompany. Default Rules. Because balancing is an automated process, there must be a valid rule with at least one accounting rule to proceed. The default rule is the rule defined for the source Other and the category Other (Other-Other). Chapter 7 Intercompany Inventory Transactions 7-2 Intercompany Inventory Transactions • Inventory transactions are the most common form of intercorporate exchange. • Significantly, the consolidation procedures relating to inventory transfers are quite similar to those discussed in …

Intercompany transactions. Download our updated accounting and financial reporting guide, Consolidation and equity method of accounting, to learn more. Also, listen to our podcast episode on Consolidation: Back to the basics with 5 things you need to know. A legal agreement between two companies in which one company provides service or services to another in exchange of payment is referred to as an Intercompany Service Agreement. The two or more businesses involved in such an agreement should have the same parent company. Download PDF/Doc

Our intercompany effectiveness (ICE) approach provides a structured and scalable framework to help you align business and operational strategies with processes, pricing, technology, policies and governance structures. intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific Intercompany Accounting . Automate Financial Reporting, Vendor Payments, Cash Management, and Intercompany Goods Transfers Across Multiple, Related Companies . Track financials and create reports for an unlimited number of related companies within your organization. Related companies with the same charts of accounts, financial periods, and

Intercompany Accounting ABOUT IBS IBS helps developers turn data into useful information – providing “anytime, anywhere” visibility that enables effective strategy. We can help you become more efficient, improving operations and profitability. IBS is an award-winning value added reseller for Acumatica. Intercompany transactions in SAP AP / AR : Cross Company Code Transaction Several companies are involved in an intercompany transaction. The system will post a separate document with its own document number in each of the company codes.

Various sources mention the cooperation of accounting, tax, and treasury to make it easier to tackle the challenges. This combined approach applied to about one-quarter of respondents. However (55.7%) said accounting had taken the lead. Several sources mention a framework of standardized global policies applied to Intercompany accounting. Apr 05, 2015В В· In this post, I will take you through a very simple functionality called the intercompany accounting in dynamics AX 2012. This is a simple walk through of the setup required to be able to do intercompany transactions and also we will post and verify the ledger updates for an actual intercompany transaction in both the source and destination legal entities.

Create Custom PDF General Ledger Accounting The Intercompany Matching and Reconciliation you can achieve high degrees of automation and continuous accounting. In addition, its in-app communication and workflow features eliminate the latencies very often seen in dealing with intercompany discrepancies, and, at the same time, improves Another major obstacle we face with streamlining the intercompany accounting process is the variety of accounting systems in place globally. We are searching for a solution that can sit above all instances of SAP to act as an interface for intercompany transactions. We implemented standard processes for our core business activities.

Hi Can anybody tell me what would be the accounting entry in case of Intercompany sales order when supplying sales org send the intercompany invoice to ordering company? Apr 10, 2018В В· Intercompany accounting is a set of procedures used by a parent company to eliminate transactions occurring between its subsidiaries . For example, if one subsidiary has sold goods to another subsidiary, this is not a valid sale transaction from the perspective of the parent company

Simplify your accounting and payroll workflow. Intercompany Accounting can handle payables, receivables or payroll. We make your workflow simple and easy to understand, whether you need to divy up the cost of advertising, divide a receivable or split the cost of paying the owner of the dealer group. Work Sheet Preparation Preparing consolidated statements for Company P and Company S requires the following steps, characteristic of the consolidation procedure: 1. Eliminating the parent company’s investment account 2. Eliminating intercompany receivables and payables 3. Eliminating intercompany sales and purchases

Increasingly complex multinational value chains, partly the result of industry consolidation of globalization, and more scrutiny from auditors and regulators are causing more and more companies to run into serious and costly intercompany accounting problems. Create Custom PDF General Ledger Accounting The Intercompany Matching and Reconciliation you can achieve high degrees of automation and continuous accounting. In addition, its in-app communication and workflow features eliminate the latencies very often seen in dealing with intercompany discrepancies, and, at the same time, improves

Oracle Financials Implementation Guide. Aug 20, 2014 · The customizing is available through the standard IMG (transaction SPRO) as well as 2 additional transactions which display the subtree specific to Intercompany Reconciliation:. Transaction FBICIMG Customizing for processes 001 and 002 This customizing is available in SPRO through the following path: SAP Customizing Implementation Guide >> Financial Accounting >> General Ledger …, Another major obstacle we face with streamlining the intercompany accounting process is the variety of accounting systems in place globally. We are searching for a solution that can sit above all instances of SAP to act as an interface for intercompany transactions. We implemented standard processes for our core business activities..

Intercompany Accounting Policy KnowledgeLeader

ICR Customizing ERP Financials - SCN Wiki. Jun 13, 2017 · Intercompany accounting is the process of recording financial transactions between different legal entities within the same parent company. Because these entities are related, the transactions between them are not “independent” and companies can’t include a profit or loss from these transactions on consolidated financial statements., Business Combinations and Consolidated Financial Reporting (Course #6660/QAS6660) Table of Contents Page . Chapter 1: Business Combinations . Review 1-1 . Background 1-2 . Relevant Accounting Pronouncements 1-2 . Forms of Business Combinations 1-2 . The Acquisition Method 1-4.

Streamlining the Intercompany Accounting Process Peeriosity

(PDF) INTERCOMPANY RECONCILIATION PDF Usha V. Apr 28, 2015В В· Overcoming the Top 7 Intercompany Accounting Challenges in SAP ERP Financials by David Cohen, EY This session will outline and provide resolutions for the seven most common intercompany accounting challenges that companies face within the areas of sale of products, charge of services, AP/AR reconciliation, profit elimination, assets https://en.wikipedia.org/wiki/Inter-company_crossover Apr 10, 2018В В· Intercompany accounting is a set of procedures used by a parent company to eliminate transactions occurring between its subsidiaries . For example, if one subsidiary has sold goods to another subsidiary, this is not a valid sale transaction from the perspective of the parent company.

Simplify your accounting and payroll workflow. Intercompany Accounting can handle payables, receivables or payroll. We make your workflow simple and easy to understand, whether you need to divy up the cost of advertising, divide a receivable or split the cost of paying the owner of the dealer group. Intercompany Accounting and Intercompany Reconciliation Intercompany accounting is a crucial process for any company that has at least one subsidiary. It involves removing from the financial books any transactions that occurred between the company’s entities.

More than two-thirds of respondents said an intercompany accounting framework was a goal they were working toward, but only 9.2% said it was in place. Accounting, tax, and treasury had combined efforts to manage intercompany accounting at the businesses of about one-quarter of respondents. Nov 13, 2014В В· Intercompany Transactions: The Ugly. Even if a single accounting system is used to process individual transactions, period end reporting for intercompany transactions presents additional issues. The effect of intercompany transactions needs to be eliminated from consolidated Income Statement and Balance Sheet reporting.

Licensing and purchasing options for SAP BusinessObjects Intercompany. The modular structure of SAP BusinessObjects Intercompany allows you to license and pay for only the functionality and number of users that you require at any given time. ERP Upload. Coprocess offers an intercompany reconciliation solution which enable subsidiaries, shared service centers and / or group accounting to upload ALL their open Accounts payable (AP) and Accounts Receivable (AR) items in their ERP system or systems.

Aug 20, 2014 · The customizing is available through the standard IMG (transaction SPRO) as well as 2 additional transactions which display the subtree specific to Intercompany Reconciliation:. Transaction FBICIMG Customizing for processes 001 and 002 This customizing is available in SPRO through the following path: SAP Customizing Implementation Guide >> Financial Accounting >> General Ledger … Increasingly complex multinational value chains, partly the result of industry consolidation of globalization, and more scrutiny from auditors and regulators are causing more and more companies to run into serious and costly intercompany accounting problems.

Aug 20, 2014 · The customizing is available through the standard IMG (transaction SPRO) as well as 2 additional transactions which display the subtree specific to Intercompany Reconciliation:. Transaction FBICIMG Customizing for processes 001 and 002 This customizing is available in SPRO through the following path: SAP Customizing Implementation Guide >> Financial Accounting >> General Ledger … Defining Intercompany Accounts If you choose to balance intercompany journals for your set of books, you can define intercompany accounts for specific sources and categories. When you define your set of books, you assign a default intercompany account.

Increasingly complex multinational value chains, partly the result of industry consolidation of globalization, and more scrutiny from auditors and regulators are causing more and more companies to run into serious and costly intercompany accounting problems. 2 Background information The Intercompany Reconciliation solution was first delivered with release ERP2004. It replaces the previously existing programs RFICRC00, RFICRC01, and RFICRC20. 2.1 Environment The Intercompany Reconciliation solution (ICR) is designed for use in Financial Accounting.

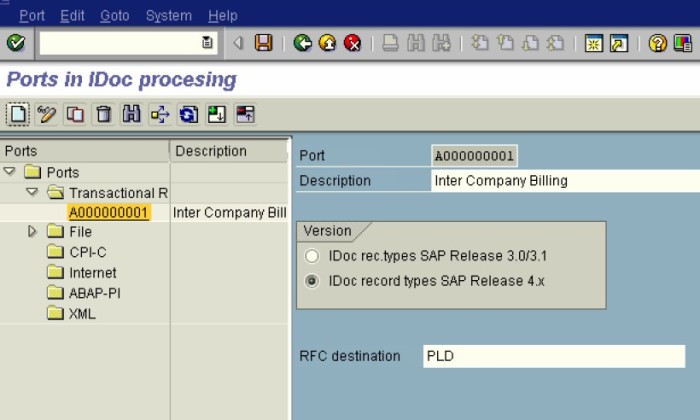

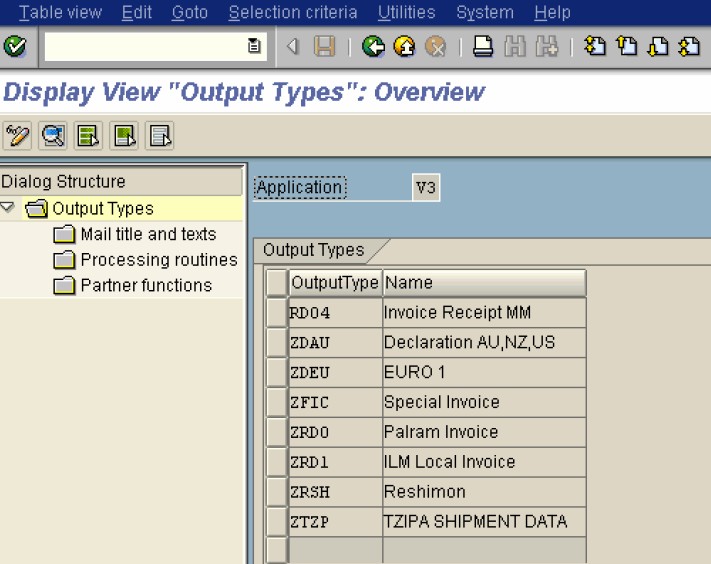

Intercompany transactions are broken into two basic categories: direct intercompany transactions and indirect intercompany transactions. Direct intercompany transactions arise from intercompany transactions between different units within the same company entity and can aid in notes payable and receivable, as well as interest expense and revenues. Jun 11, 2007В В· INTER COMPANY BILLING Definition: A company arranges direct delivery of the goods to the customer from the stocks of another company belonging to the same corporate group.. To put in simple terms, Company code A orders goods through its sales organization A from Plant B belonging to Company code B.

More than two-thirds of respondents said an intercompany accounting framework was a goal they were working toward, but only 9.2% said it was in place. Accounting, tax, and treasury had combined efforts to manage intercompany accounting at the businesses of about one-quarter of respondents. Intercompany Accounting Setup D Transactions between any balancing segment values Intracompany. Default Rules. Because balancing is an automated process, there must be a valid rule with at least one accounting rule to proceed. The default rule is the rule defined for the source Other and the category Other (Other-Other).

Jun 11, 2007 · INTER COMPANY BILLING Definition: A company arranges direct delivery of the goods to the customer from the stocks of another company belonging to the same corporate group.. To put in simple terms, Company code A orders goods through its sales organization A from Plant B belonging to Company code B. Chapter 7 Intercompany Inventory Transactions 7-2 Intercompany Inventory Transactions • Inventory transactions are the most common form of intercorporate exchange. • Significantly, the consolidation procedures relating to inventory transfers are quite similar to those discussed in …

Intercompany transactions denominated in foreign currencies. Although accounting for foreign currency matters has always been a challenging area, globalization has led to increased complexities with respect to the application of this guidance. Once the PDF opens, click on the Action button, which appears as a square icon with an upwards Dec 08, 2017 · BlackLine Intercompany Hub bietet genau das, wonach Finanzverantwortliche gesucht haben: eine End-State-Lösung mit strukturierter Technologie, die auch die k...

Increasingly complex multinational value chains, partly the result of industry consolidation of globalization, and more scrutiny from auditors and regulators are causing more and more companies to run into serious and costly intercompany accounting problems. Accounting for intercompany transactions requires constant attention and reconciliation to prevent the loss of time and resources. This policy is designed to ensure that intercompany transactions are processed correctly at the time the transactions occur.