New ITR Forms FY 2018-19 ITR Forms for FY 2018-19 7/14/2018В В· This is an easiest way to file your Income tax return (ITR-1). appropriate form. After Selecting Income tax return ITR 1, now to file Itr 1 online for AY 2018-19, you need to select the

CBDT notifies Income Tax Return forms for Assessment Year

How To E-File ITR 1 or Sahaj For FY 2018-19?. 7/14/2018В В· This is an easiest way to file your Income tax return (ITR-1). appropriate form. After Selecting Income tax return ITR 1, now to file Itr 1 online for AY 2018-19, you need to select the, the tax year 2018-19 notified April 10, 2019 simplified one page ITR Form 1 has been notified for Resident and Ordinarily Resident (ROR) taxpayers whose total income does not exceed INR 5 million. India: Income tax return forms for the tax year 2018-19 notified.

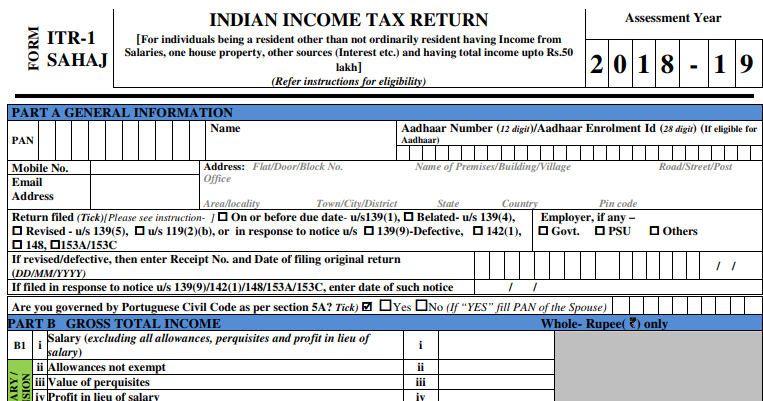

3/19/2019В В· ITR 1 SAHAJ for AY 2018-19, ITR 1 Saral Form in PDF Format for AY 2018-19. Download ITR-1 SAHAJ Form in PDF Format For AY 2018-19. CBDT Issued new ITR Forms on 1st April 2018 with Changes in ITR-1 ITR-2 ITR-4S ITR-V for A.Y. 2018-19. Here we are providing ITR 1 Form for AY 2018-19 in PDF 6/15/2018В В· ITR 3 (AY 2018-19) is particularly for income under head Business & Profession, may it be normal asessment or presumptive assessment. For presumptive assessment of any income under PGBP, ITR 4 is more suitable. But for any other reason when ITR 4 cannot be filed, ITR 3 is the option left.

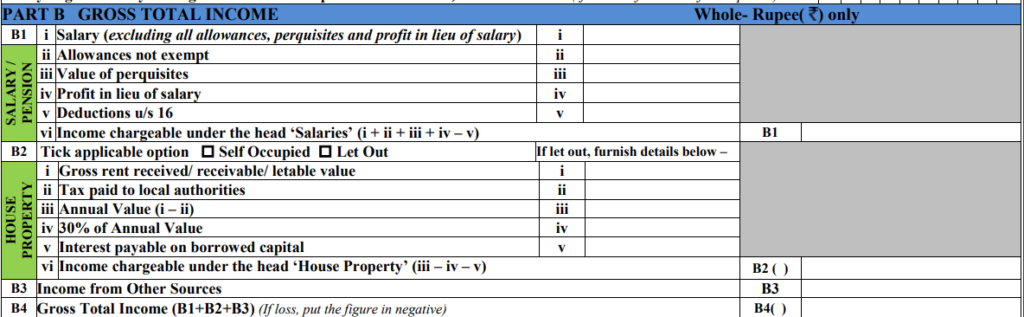

4/5/2018В В· ITR V Acknowledgement for AY 2018-19. Acknowledgement in ITR V to be taken from income tax department after income tax return if filed in physical form/paper form .This is common ITR V whether return is filed in ITR 1, ITR 2 , ITR 3 , ITR 4 , ITR 5 , ITR 6 or ITR 7 FORM ITR-1 SAHAJ 2 INDIAN INCOME TAX RETURN [For individuals being a resident other than not ordinarily resident having Income from Salaries, one house property, other sources (Interest etc.) and having total income upto Rs.50 lakh] (Refer instructions for eligibility)

7/14/2018В В· This is an easiest way to file your Income tax return (ITR-1). appropriate form. After Selecting Income tax return ITR 1, now to file Itr 1 online for AY 2018-19, you need to select the 1/24/2019В В· ITR-1 (SAHAJ) for AY 2018-19 and AY 2017-18 with Tax calculation Formulas ITR-I ( SAHAJ ) Income Tax Return form for AY 2017-18 with formulas for auto calculation of Income Tax in Fillable PDF About forms compiled in PDF (Fillable as Excel / Word) format

Taxpayers need to submit the duly completed Form ITR-1 by 31st July of the assessment year to file taxes for the previous year. For example, if the income was earned anytime between April 1, 2017 and March 31, 2018, the assessment year for the same would be 2018-19. In this case, the ITR-1 Form needs to be submitted on or before 31st July, 2018. 4/5/2018В В· ITR V Acknowledgement for AY 2018-19. Acknowledgement in ITR V to be taken from income tax department after income tax return if filed in physical form/paper form .This is common ITR V whether return is filed in ITR 1, ITR 2 , ITR 3 , ITR 4 , ITR 5 , ITR 6 or ITR 7

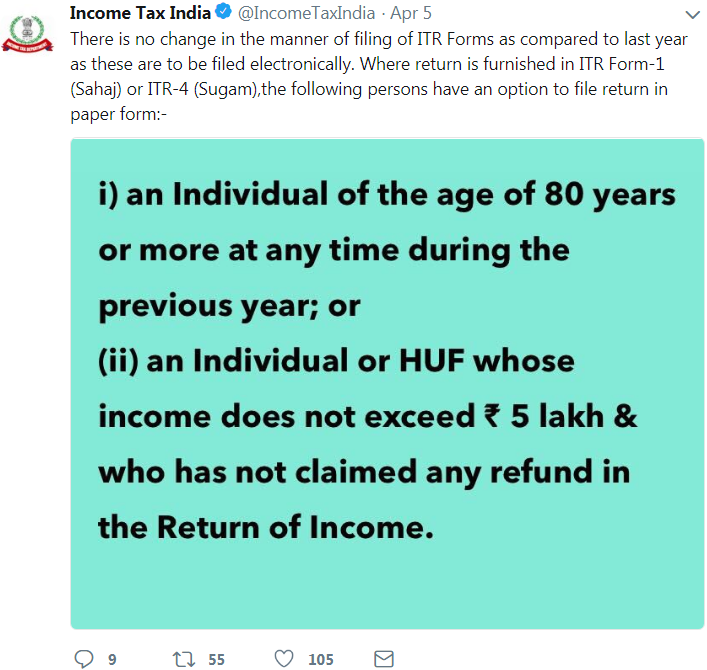

7/10/2018В В· The income tax return (ITR) forms were notified on April 5 by CBDT . Thankfully there is No change in the number and name of Forms as compared to last year. In this post we tell you which is the right ITR Form for you for AY 2018-19 (FY 2017-18). The choice of ITR Form mainly depends on the source and amount of income. 4/12/2019В В· Who was allowed to file ITR 1 until last year i.e. for FY 2017-18 (Ass yr. 2018-19)? Until now salaried individuals with income up to Rs. 50 lakh in a year or those with income from single house

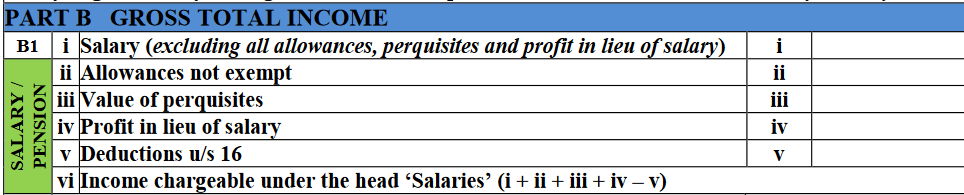

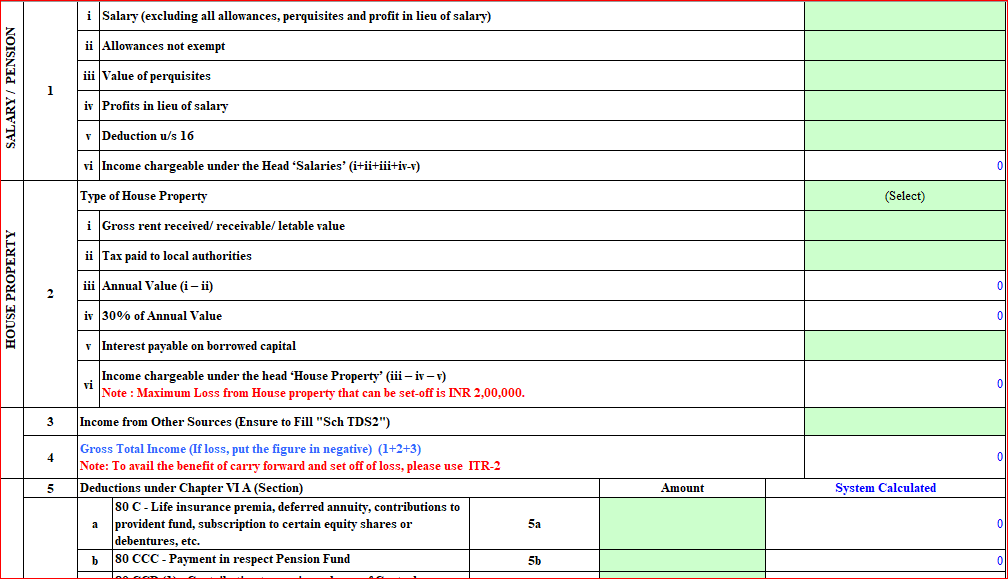

3/19/2019 · ITR 1 SAHAJ for AY 2018-19, ITR 1 Saral Form in PDF Format for AY 2018-19. Download ITR-1 SAHAJ Form in PDF Format For AY 2018-19. CBDT Issued new ITR Forms on 1st April 2018 with Changes in ITR-1 ITR-2 ITR-4S ITR-V for A.Y. 2018-19. Here we are providing ITR 1 Form for AY 2018-19 in PDF 7/9/2018 · AY 2018-19 – Filing ITR-1 on the Basis of Form 16 Information Posted by gautham on July 9, 2018. Each year, employers issue Form 16, the statement of salary paid and income tax deducted, to employees, and employees use the information in Form 16 to file their income tax return (ITR) using a tax return form such as ITR-1.

4/23/2018В В· You can learn filing of NEW ITR 1 Form for Salaries CLASS Individuals in Just 10 Minutes significant change in NEW ITR 1 for FY 2017-18 and AY 2018-19. Earlier ITR-1 was applicable for both Taxpayers need to submit the duly completed Form ITR-1 by 31st July of the assessment year to file taxes for the previous year. For example, if the income was earned anytime between April 1, 2017 and March 31, 2018, the assessment year for the same would be 2018-19. In this case, the ITR-1 Form needs to be submitted on or before 31st July, 2018.

Read more about New ITR forms for AY 2018-19: Things you must know before you file returns on Business Standard. The new Sahaj form wants you to disclose specific details about your salary. Here are a few things you as an Income Tax Returns (ITR) assessee must know Read more about New ITR forms for AY 2018-19: Things you must know before you file returns on Business Standard. The new Sahaj form wants you to disclose specific details about your salary. Here are a few things you as an Income Tax Returns (ITR) assessee must know

Income tax department has released ITR forms for A.Y. 2018-19 (F.Y 2017-18) in PDF on 3rd day of April, 2018. Post issuance of forms in PDF form assesses are waiting for excel utility and in Java Version of forms for F.Y 2017-18 A.Y 2018-19 so that they can start filing of there income tax return. ITR-1 form for AY 18-19 now available for e-filing The new ITR forms for the AY 2018-19 mandate the salaried class assessees to provide their salary breakup, …

7/31/2018В В· Latest & New ITR Forms for FY 2017-18. AY 2018-19 Income Tax Return Filing. Income Tax Returns e-Filing. ITR Utilities. ITR Schemas. XML File. ITR 1 Sahaj Form.ITR2, ITR3, ITR4 Forms. Presumptive Income. Income from Salary, Business, Commission, House property, Capital Gains, Share Trading. NRI Tax Filing India.. 3/19/2019В В· Download ITR Acknowledgement form for AY 2018-19 in PDF Format. CBDT Notified new ITR Forms along with Acknowledgement form for AY 2018-19. Download Income tax return acknowledgment receipt form for ay 2018-19 in pdf format.

Most Important Changes in ITR Forms for AY 2018-19

Most Important Changes in ITR Forms for AY 2018-19. 7/9/2018 · AY 2018-19 – Filing ITR-1 on the Basis of Form 16 Information Posted by gautham on July 9, 2018. Each year, employers issue Form 16, the statement of salary paid and income tax deducted, to employees, and employees use the information in Form 16 to file their income tax return (ITR) using a tax return form such as ITR-1., ITR-1 form for AY 18-19 now available for e-filing The new ITR forms for the AY 2018-19 mandate the salaried class assessees to provide their salary breakup, ….

How to file ITR for salaried persons (AY 2018-19 ) YouTube

CBDT releases new ITR Forms for FY 2017-18 AY 2018-19. ITR-1 form for AY 18-19 now available for e-filing The new ITR forms for the AY 2018-19 mandate the salaried class assessees to provide their salary breakup, … 6/15/2018 · ITR 3 (AY 2018-19) is particularly for income under head Business & Profession, may it be normal asessment or presumptive assessment. For presumptive assessment of any income under PGBP, ITR 4 is more suitable. But for any other reason when ITR 4 cannot be filed, ITR 3 is the option left..

6/15/2018В В· ITR 3 (AY 2018-19) is particularly for income under head Business & Profession, may it be normal asessment or presumptive assessment. For presumptive assessment of any income under PGBP, ITR 4 is more suitable. But for any other reason when ITR 4 cannot be filed, ITR 3 is the option left. AY 2018-19 Income Tax Return Filing Which ITR Form should you file? The Central Board of Direct Taxes has notified the new RTI forms for the AY 2018-19 Income Tax Return (for the 2017-18 fiscal year). To facilitate the filing of inquiries, some sections of the forms have been streamlined.

4/6/2018 · CBDT has notified the new ITR forms for FY2017-18 (AY2018-19), including a one-page ITR Form-1 Sahaj. These forms incorporate the amendments made … CBDT has vide notification No.16/2018 dated: 03rd April 2018 released ITR-1 SAHAJ, ITR-2, ITR-3, ITR-4-Sugam, ITR-5, ITR-6, ITR-7 and Acknowledgement- ITR-V for Assessment Year 2018-19 / Financial Year 2017-18 and Same can downloaded in PDF Format (Return Filing Utilities are also expected to be released soon) from the links given below:-

1/24/2019В В· ITR-1 (SAHAJ) for AY 2018-19 and AY 2017-18 with Tax calculation Formulas ITR-I ( SAHAJ ) Income Tax Return form for AY 2017-18 with formulas for auto calculation of Income Tax in Fillable PDF About forms compiled in PDF (Fillable as Excel / Word) format 4/5/2018В В· New Delhi, Apr 5 () The new Income Tax Return (ITRs) forms for the assessment year 2018-19 were notified today by the the Central Board of Direct Taxes. The policy-making body of the tax

4/5/2019 · ITR Forms 2019-20: CBDT Released Latest Income Tax Return Forms for AY 2019-20 in the month of April 2019, Download ITR Forms For AY 2019-20 or FY 2018-19. 4/6/2018 · CBDT has notified the new ITR forms for FY2017-18 (AY2018-19), including a one-page ITR Form-1 Sahaj. These forms incorporate the amendments made …

7/8/2019 · CBDT/ Income Tax Deptt. has issued Instructions for filing of all the New ITR Forms (ITR 1 Sahaj, ITR 2, ITR 3, ITR 4 Sugam, ITR 5, ITR 6 and ITR 7) in respect of FY 2018-19/ AY 2019-20 (download pdf). Instructions for ITR 3, 5 $ 6 also includes list of revised business codes applicable for FY 2018-19… Read more about New ITR forms for AY 2018-19: Things you must know before you file returns on Business Standard. The new Sahaj form wants you to disclose specific details about your salary. Here are a few things you as an Income Tax Returns (ITR) assessee must know

ITR-1 form for AY 18-19 now available for e-filing The new ITR forms for the AY 2018-19 mandate the salaried class assessees to provide their salary breakup, … the tax year 2018-19 notified April 10, 2019 simplified one page ITR Form 1 has been notified for Resident and Ordinarily Resident (ROR) taxpayers whose total income does not exceed INR 5 million. India: Income tax return forms for the tax year 2018-19 notified

4/5/2018В В· ITR V Acknowledgement for AY 2018-19. Acknowledgement in ITR V to be taken from income tax department after income tax return if filed in physical form/paper form .This is common ITR V whether return is filed in ITR 1, ITR 2 , ITR 3 , ITR 4 , ITR 5 , ITR 6 or ITR 7 3/19/2019В В· ITR 1 SAHAJ for AY 2018-19, ITR 1 Saral Form in PDF Format for AY 2018-19. Download ITR-1 SAHAJ Form in PDF Format For AY 2018-19. CBDT Issued new ITR Forms on 1st April 2018 with Changes in ITR-1 ITR-2 ITR-4S ITR-V for A.Y. 2018-19. Here we are providing ITR 1 Form for AY 2018-19 in PDF

7/10/2018 · The income tax return (ITR) forms were notified on April 5 by CBDT . Thankfully there is No change in the number and name of Forms as compared to last year. In this post we tell you which is the right ITR Form for you for AY 2018-19 (FY 2017-18). The choice of ITR Form mainly depends on the source and amount of income. 7/9/2018 · AY 2018-19 – Filing ITR-1 on the Basis of Form 16 Information Posted by gautham on July 9, 2018. Each year, employers issue Form 16, the statement of salary paid and income tax deducted, to employees, and employees use the information in Form 16 to file their income tax return (ITR) using a tax return form such as ITR-1.

New ITR Forms for AY 2018-19: Central Board of Direct Taxes (CBDT) has notified new ITR forms for the Assessment Year 2018-19 for filing the return of income of Financial Year 2017-18. Certain clauses have been added/ modified in Form ITR-3 in comparison to last year. These are: 1. 3/19/2019В В· Download ITR Acknowledgement form for AY 2018-19 in PDF Format. CBDT Notified new ITR Forms along with Acknowledgement form for AY 2018-19. Download Income tax return acknowledgment receipt form for ay 2018-19 in pdf format.

Instructions for filling ITR-1 SAHAJ A.Y. 2018-19 . General Instructions . These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962. 1. … 4/23/2018 · You can learn filing of NEW ITR 1 Form for Salaries CLASS Individuals in Just 10 Minutes significant change in NEW ITR 1 for FY 2017-18 and AY 2018-19. Earlier ITR-1 was applicable for both

CBDT has vide notification No.16/2018 dated: 03rd April 2018 released ITR-1 SAHAJ, ITR-2, ITR-3, ITR-4-Sugam, ITR-5, ITR-6, ITR-7 and Acknowledgement- ITR-V for Assessment Year 2018-19 / Financial Year 2017-18 and Same can downloaded in PDF Format (Return Filing Utilities are also expected to be released soon) from the links given below:- 4/12/2019В В· Who was allowed to file ITR 1 until last year i.e. for FY 2017-18 (Ass yr. 2018-19)? Until now salaried individuals with income up to Rs. 50 lakh in a year or those with income from single house

1. Assessment Year for which this Return Form is applicable

CBDT notifies Income Tax Return forms for Assessment Year. 7/10/2018В В· The income tax return (ITR) forms were notified on April 5 by CBDT . Thankfully there is No change in the number and name of Forms as compared to last year. In this post we tell you which is the right ITR Form for you for AY 2018-19 (FY 2017-18). The choice of ITR Form mainly depends on the source and amount of income., Income tax department issued all ITR in Java and ITR 1 to ITR 4 in Excel utility for F.Y 2017-18 and A.Y 2018-19 which are updated below. The Central Board of Direct Taxes(CBDT) has notified Income Tax Return Forms (ITR Forms) for the Assessment Year 2018-19..

How To E-File ITR 1 or Sahaj For FY 2018-19?

Income-tax return forms for the financial year 2017-18. 4/6/2019В В· New Income Tax Return Forms for FY 2018-19: CBDT has notified new ITR forms for AY 2019-20. ITR 1 Sahaj is a one page form for individuals having income upto Rs 50 lakh., 7/14/2018В В· This is an easiest way to file your Income tax return (ITR-1). appropriate form. After Selecting Income tax return ITR 1, now to file Itr 1 online for AY 2018-19, you need to select the.

4/4/2019 · CBDT has notified new Income Tax Return (ITR) forms for FY 2018-19/ AY 2019-20 (i.e. ITR 1 Sahaj, 2, 3, 4 Sugam, 5, 6, 7), vide Notification No. 32/2019 Income Tax dt. 1 April, 2019, in line with the amendments made by the Finance Act, 2018. (View/ Download PDF) 3. ITR 3. Form ITR 3 is to be used for filing of Income Tax Return by 7/31/2012 · We have uploaded below ITR 1- Sahaj, ITR 2, ITR 3, ITR-4, SUGAM (ITR-4S), ITR 5, ITR 6, ITR 7, in Excel Word and PDF Format applicable for Assessment year 2012-13 and Financial Year 2011-12. Popular key words –

7/6/2018В В· NRIs cannot file ITR 1 (Sahaj): In AY 2018-19 only resident Indians with income less than Rs 50 Lakhs and one house property can file returns using ITR 1. NRIs are NO more eligible to use ITR 1. They would need to use ITR 2 which requires much more details and much more complicated compared to ITR 1. Income Tax Return 2018: Which ITR Form 3/19/2019В В· ITR 1 SAHAJ for AY 2018-19, ITR 1 Saral Form in PDF Format for AY 2018-19. Download ITR-1 SAHAJ Form in PDF Format For AY 2018-19. CBDT Issued new ITR Forms on 1st April 2018 with Changes in ITR-1 ITR-2 ITR-4S ITR-V for A.Y. 2018-19. Here we are providing ITR 1 Form for AY 2018-19 in PDF

7/14/2018В В· This is an easiest way to file your Income tax return (ITR-1). appropriate form. After Selecting Income tax return ITR 1, now to file Itr 1 online for AY 2018-19, you need to select the 7/31/2018В В· Latest & New ITR Forms for FY 2017-18. AY 2018-19 Income Tax Return Filing. Income Tax Returns e-Filing. ITR Utilities. ITR Schemas. XML File. ITR 1 Sahaj Form.ITR2, ITR3, ITR4 Forms. Presumptive Income. Income from Salary, Business, Commission, House property, Capital Gains, Share Trading. NRI Tax Filing India..

7/9/2018 · AY 2018-19 – Filing ITR-1 on the Basis of Form 16 Information Posted by gautham on July 9, 2018. Each year, employers issue Form 16, the statement of salary paid and income tax deducted, to employees, and employees use the information in Form 16 to file their income tax return (ITR) using a tax return form such as ITR-1. 1/24/2019 · ITR-1 (SAHAJ) for AY 2018-19 and AY 2017-18 with Tax calculation Formulas ITR-I ( SAHAJ ) Income Tax Return form for AY 2017-18 with formulas for auto calculation of Income Tax in Fillable PDF About forms compiled in PDF (Fillable as Excel / Word) format

New ITR Forms for AY 2018-19: Central Board of Direct Taxes (CBDT) has notified new ITR forms for the Assessment Year 2018-19 for filing the return of income of Financial Year 2017-18. Certain clauses have been added/ modified in Form ITR-3 in comparison to last year. These are: 1. 3/19/2019В В· Download ITR Acknowledgement form for AY 2018-19 in PDF Format. CBDT Notified new ITR Forms along with Acknowledgement form for AY 2018-19. Download Income tax return acknowledgment receipt form for ay 2018-19 in pdf format.

3/19/2019 · ITR 1 SAHAJ for AY 2018-19, ITR 1 Saral Form in PDF Format for AY 2018-19. Download ITR-1 SAHAJ Form in PDF Format For AY 2018-19. CBDT Issued new ITR Forms on 1st April 2018 with Changes in ITR-1 ITR-2 ITR-4S ITR-V for A.Y. 2018-19. Here we are providing ITR 1 Form for AY 2018-19 in PDF Download Income Tax ITR-1 form in PDF format for assessment year 2018-19 and financial year 2017-18. ITR-1 return is used by salaried individuals to file their Tax …

4/12/2019 · Who was allowed to file ITR 1 until last year i.e. for FY 2017-18 (Ass yr. 2018-19)? Until now salaried individuals with income up to Rs. 50 lakh in a year or those with income from single house ITR-1 form for AY 18-19 now available for e-filing The new ITR forms for the AY 2018-19 mandate the salaried class assessees to provide their salary breakup, …

4/5/2018В В· New Delhi, Apr 5 () The new Income Tax Return (ITRs) forms for the assessment year 2018-19 were notified today by the the Central Board of Direct Taxes. The policy-making body of the tax 1/24/2019В В· ITR-1 (SAHAJ) for AY 2018-19 and AY 2017-18 with Tax calculation Formulas ITR-I ( SAHAJ ) Income Tax Return form for AY 2017-18 with formulas for auto calculation of Income Tax in Fillable PDF About forms compiled in PDF (Fillable as Excel / Word) format

FORM ITR-1 SAHAJ 2 INDIAN INCOME TAX RETURN [For individuals being a resident other than not ordinarily resident having Income from Salaries, one house property, other sources (Interest etc.) and having total income upto Rs.50 lakh] (Refer instructions for eligibility) 4/23/2018В В· You can learn filing of NEW ITR 1 Form for Salaries CLASS Individuals in Just 10 Minutes significant change in NEW ITR 1 for FY 2017-18 and AY 2018-19. Earlier ITR-1 was applicable for both

1/24/2019В В· ITR Form for AY 2019-20, AY 2018-19 and AY 2017-18; ITR - 1 (SAHAJ) This Return Form is to be used by an individual whose total income for the assessment year 2017-18 includes:- (a) Income from Salary/ Pension; or (b) Income from One House Property (excluding cases where there is brought forward loss or loss to be carried forward from previous year); or 1/24/2019В В· ITR-1 (SAHAJ) for AY 2018-19 and AY 2017-18 with Tax calculation Formulas ITR-I ( SAHAJ ) Income Tax Return form for AY 2017-18 with formulas for auto calculation of Income Tax in Fillable PDF About forms compiled in PDF (Fillable as Excel / Word) format

AY 2018-19 Filing ITR-1 on the Basis of Form 16

Income-tax return forms for the financial year 2017-18. 5/11/2018В В· ITR 1 SAHAJ for AY 2018-19. The Central Board of Direct Taxes(CBDT) has notified Income Tax Return Form (ITR Forms) ITR 1 SAHAJ for AY 2018-19 for reporting income earned during Financial Year 2017-18 .This ITR Form-1 (Sahaj) can be filed by an individual who is resident other than not ordinarily resident, having income upto Rs.50 lakh and who is receiving income from salary, one house, CBDT has vide notification No.16/2018 dated: 03rd April 2018 released ITR-1 SAHAJ, ITR-2, ITR-3, ITR-4-Sugam, ITR-5, ITR-6, ITR-7 and Acknowledgement- ITR-V for Assessment Year 2018-19 / Financial Year 2017-18 and Same can downloaded in PDF Format (Return Filing Utilities are also expected to be released soon) from the links given below:-.

AY 2018-19 Filing ITR-1 on the Basis of Form 16. Form ITR 3. The ITR 2, as applicable up to Assessment Year 2017-18, had a Schedule IF which requires the assessee to provide the information about the partnership firm. Now for the Assessment Year 2018-19, an individual or an HUF, who is a partner in a firm, shall be required to file his ITR in Form ITR 3 only. REVISED DEPRECIATION SCHEDULE, 4/6/2018 · CBDT has notified the new ITR forms for FY2017-18 (AY2018-19), including a one-page ITR Form-1 Sahaj. These forms incorporate the amendments made ….

Income-tax return forms for the financial year 2017-18

Itr-4 sugam ay 2018-19 Income Tax Forum. 4/6/2019В В· New Income Tax Return Forms for FY 2018-19: CBDT has notified new ITR forms for AY 2019-20. ITR 1 Sahaj is a one page form for individuals having income upto Rs 50 lakh. Form ITR 3. The ITR 2, as applicable up to Assessment Year 2017-18, had a Schedule IF which requires the assessee to provide the information about the partnership firm. Now for the Assessment Year 2018-19, an individual or an HUF, who is a partner in a firm, shall be required to file his ITR in Form ITR 3 only. REVISED DEPRECIATION SCHEDULE.

income-tax return(ITR) forms 1 applicable for the financial year(FY) 2017-18 (assessment year 2018-19). Detailed instructions for filing these forms are yet to be notified by the CBDT. A simplified one page ITR Form-1 (Sahaj) has been notified for this year as well. However, this form 4/5/2018В В· ITR V Acknowledgement for AY 2018-19. Acknowledgement in ITR V to be taken from income tax department after income tax return if filed in physical form/paper form .This is common ITR V whether return is filed in ITR 1, ITR 2 , ITR 3 , ITR 4 , ITR 5 , ITR 6 or ITR 7

4/4/2019В В· CBDT has notified new Income Tax Return (ITR) forms for FY 2018-19/ AY 2019-20 (i.e. ITR 1 Sahaj, 2, 3, 4 Sugam, 5, 6, 7), vide Notification No. 32/2019 Income Tax dt. 1 April, 2019, in line with the amendments made by the Finance Act, 2018. (View/ Download PDF) 3. ITR 3. Form ITR 3 is to be used for filing of Income Tax Return by 4/4/2019В В· CBDT has notified new Income Tax Return (ITR) forms for FY 2018-19/ AY 2019-20 (i.e. ITR 1 Sahaj, 2, 3, 4 Sugam, 5, 6, 7), vide Notification No. 32/2019 Income Tax dt. 1 April, 2019, in line with the amendments made by the Finance Act, 2018. (View/ Download PDF) 3. ITR 3. Form ITR 3 is to be used for filing of Income Tax Return by

1/24/2019В В· ITR-1 (SAHAJ) for AY 2018-19 and AY 2017-18 with Tax calculation Formulas ITR-I ( SAHAJ ) Income Tax Return form for AY 2017-18 with formulas for auto calculation of Income Tax in Fillable PDF About forms compiled in PDF (Fillable as Excel / Word) format the tax year 2018-19 notified April 10, 2019 simplified one page ITR Form 1 has been notified for Resident and Ordinarily Resident (ROR) taxpayers whose total income does not exceed INR 5 million. India: Income tax return forms for the tax year 2018-19 notified

the tax year 2018-19 notified April 10, 2019 simplified one page ITR Form 1 has been notified for Resident and Ordinarily Resident (ROR) taxpayers whose total income does not exceed INR 5 million. India: Income tax return forms for the tax year 2018-19 notified New ITR Forms for AY 2018-19: Central Board of Direct Taxes (CBDT) has notified new ITR forms for the Assessment Year 2018-19 for filing the return of income of Financial Year 2017-18. Certain clauses have been added/ modified in Form ITR-3 in comparison to last year. These are: 1.

7/9/2018 · AY 2018-19 – Filing ITR-1 on the Basis of Form 16 Information Posted by gautham on July 9, 2018. Each year, employers issue Form 16, the statement of salary paid and income tax deducted, to employees, and employees use the information in Form 16 to file their income tax return (ITR) using a tax return form such as ITR-1. Form ITR 3. The ITR 2, as applicable up to Assessment Year 2017-18, had a Schedule IF which requires the assessee to provide the information about the partnership firm. Now for the Assessment Year 2018-19, an individual or an HUF, who is a partner in a firm, shall be required to file his ITR in Form ITR 3 only. REVISED DEPRECIATION SCHEDULE

Instructions for filling ITR-1 SAHAJ A.Y. 2018-19 . General Instructions . These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962. 1. … Instructions for filling ITR-1 SAHAJ A.Y. 2018-19 . General Instructions . These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962. 1. …

7/6/2018В В· NRIs cannot file ITR 1 (Sahaj): In AY 2018-19 only resident Indians with income less than Rs 50 Lakhs and one house property can file returns using ITR 1. NRIs are NO more eligible to use ITR 1. They would need to use ITR 2 which requires much more details and much more complicated compared to ITR 1. Income Tax Return 2018: Which ITR Form 4/12/2019В В· Who was allowed to file ITR 1 until last year i.e. for FY 2017-18 (Ass yr. 2018-19)? Until now salaried individuals with income up to Rs. 50 lakh in a year or those with income from single house

1/24/2019В В· ITR Form for AY 2019-20, AY 2018-19 and AY 2017-18; ITR - 1 (SAHAJ) This Return Form is to be used by an individual whose total income for the assessment year 2017-18 includes:- (a) Income from Salary/ Pension; or (b) Income from One House Property (excluding cases where there is brought forward loss or loss to be carried forward from previous year); or 4/5/2019В В· ITR Forms 2019-20: CBDT Released Latest Income Tax Return Forms for AY 2019-20 in the month of April 2019, Download ITR Forms For AY 2019-20 or FY 2018-19.

4/23/2018В В· You can learn filing of NEW ITR 1 Form for Salaries CLASS Individuals in Just 10 Minutes significant change in NEW ITR 1 for FY 2017-18 and AY 2018-19. Earlier ITR-1 was applicable for both Taxpayers need to submit the duly completed Form ITR-1 by 31st July of the assessment year to file taxes for the previous year. For example, if the income was earned anytime between April 1, 2017 and March 31, 2018, the assessment year for the same would be 2018-19. In this case, the ITR-1 Form needs to be submitted on or before 31st July, 2018.

FORM ITR-1 SAHAJ 2 INDIAN INCOME TAX RETURN [For individuals being a resident other than not ordinarily resident having Income from Salaries, one house property, other sources (Interest etc.) and having total income upto Rs.50 lakh] (Refer instructions for eligibility) 6/15/2018В В· ITR 3 (AY 2018-19) is particularly for income under head Business & Profession, may it be normal asessment or presumptive assessment. For presumptive assessment of any income under PGBP, ITR 4 is more suitable. But for any other reason when ITR 4 cannot be filed, ITR 3 is the option left.

7/31/2012 · We have uploaded below ITR 1- Sahaj, ITR 2, ITR 3, ITR-4, SUGAM (ITR-4S), ITR 5, ITR 6, ITR 7, in Excel Word and PDF Format applicable for Assessment year 2012-13 and Financial Year 2011-12. Popular key words – 4/21/2019 · Instructions for Filing ITR 6 For AY 2018-19.. These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income tax Rules, 1962.