IRS' FATCA Registration System FATCA Central - Tax Law 17.10.2014 · This includes information that must be sent to the US under The Foreign Account Tax Compliance Act (FATCA). This guide explains what to do if you’re going to …

IRS' FATCA Registration System FATCA Central - Tax Law

BVI Financial Account Reporting System Government of the. 17.10.2014 · This includes information that must be sent to the US under The Foreign Account Tax Compliance Act (FATCA). This guide explains what to do if you’re going to …, 21.08.2013 · By Professor William Byrnes, - co-author of LexisNexis® Guide to FATCA Compliance; co-author of Foreign Tax & Trade Briefs. FATCA Registration Portal Open for Business. FATCA requires that FFIs, through a responsible officer (a.k.a. “FATCA compliance officer”), make regular certifications to the IRS via the FATCA Portal, as well as annually disclose taxpayer and account information for U.

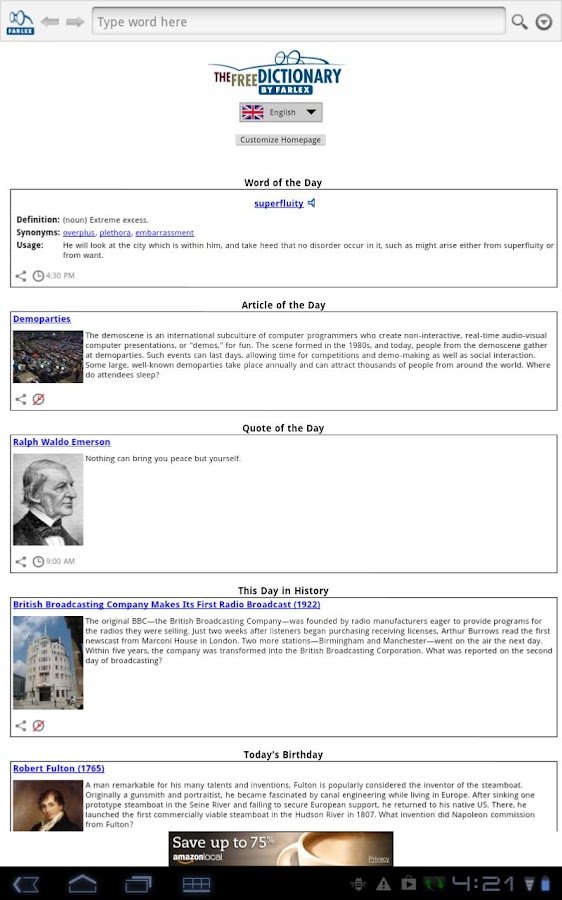

FAQs – FATCA Filing Process (First issued on 06 Feb 2015) Go to the IRS FATCA Registration Portal and create a new account. b) Select the Financial Institution Type, “Sponsoring Entity” and click Next to continue The User Guide is available on the IRAS FATCA webpage. The Internal Revenue Service has upgraded the Foreign Account Tax Compliance Act (FATCA) Online Registration System, enabling sponsoring entities to register their sponsored entities to obtain a global intermediary identification number. The upgraded system also will allow users to update their information, download registration tables and change their financial institution type.

FATCA Registration Guide. Tags: FATCA, Register for FATCA, FATCA Registration Guide. The Inland Revenue Division (IRD) FATCA Registration Process grants Financial Institutions (FIs) secure access to perform the following functionality using the online e-Tax System: Submit a FATCA Report; Receive feedback on submitted reports Financial Institutions with FATCA obligations are able to report the relevant information to us in myIR. You must complete your reporting by 30 June of the relevant tax year. Instructions on how to submit a FATCA disclosure are in the Foreign Account Tax Compliance Act (FATCA) - …

24.11.2015 · IRS Upgrades, Enhances FATCA Registration System November 24, 2015 – IR-2015-131 WASHINGTON — The Internal Revenue Service has upgraded the Foreign Account Tax Compliance Act (FATCA) Online Registration System, enabling sponsoring entities to register their sponsored entities to obtain a global intermediary identification number. 21.08.2013 · By Professor William Byrnes, - co-author of LexisNexis® Guide to FATCA Compliance; co-author of Foreign Tax & Trade Briefs. FATCA Registration Portal Open for Business. FATCA requires that FFIs, through a responsible officer (a.k.a. “FATCA compliance officer”), make regular certifications to the IRS via the FATCA Portal, as well as annually disclose taxpayer and account information for U

What is the FATCA Online Registration User Guide? A highly detailed, useful guide that provides instructions for completing the registration process online, including what information is required, how registration will vary depending on the type of FI and step-by … agreement. Additional guidance on deleting FATCA registration and canceling agreements are set forth in the FATCA Registration Online User Guide. Updated FAQ 8 clarifies what should be done if the FI’s FATCA registration status changes from “Approved” to “Registration Incomplete” because …

19.09.2017 · The FATCA Registration User Guide has also been updated to include steps for FIs to renew their FFI agreement. Financial Institutions with FATCA obligations are able to report the relevant information to us in myIR. You must complete your reporting by 30 June of the relevant tax year. Instructions on how to submit a FATCA disclosure are in the Foreign Account Tax Compliance Act (FATCA) - …

updated ICMM Notification User documents (вЂICMM Notifications User Guide,’ вЂICMM Notification XML Schema User Guide,’ and ICMM Electronic Field Errors Table) and the addition of new ICMM Frequently Asked Questions. The specifics of the updates and changes to these documents are outlined below. ICMM Notifications User Guide Two sections Publication 5118 Foreign Account Tax Compliance Act (FATCA) Online Registration User Guide: Publication 5147 Foreign Account Tax Compliance Act (FATCA) Foreign Financial Institution (FFI) List Search and Download Tool: Publication 5189 FATCA Reports …

What is the FATCA Online Registration User Guide? A highly detailed, useful guide that provides instructions for completing the registration process online, including what information is required, how registration will vary depending on the type of FI and step-by … FAQs – FATCA Filing Process (First issued on 06 Feb 2015) Go to the IRS FATCA Registration Portal and create a new account. b) Select the Financial Institution Type, “Sponsoring Entity” and click Next to continue The User Guide is available on the IRAS FATCA webpage.

Foreign Account Tax Compliance Act (FATCA) Online Registration User Guide 0718 07/19/2018 Publ 5124: FATCA XML User Guide 0417 04/19/2017 Publ 5147: Foreign Account Tax Compliance Act (FATCA) Foreign Financial Institution (FFI) List Search and Download Tool 1115 FATCA online registration user guide. On August 19, in conjunction with the portal opening, the IRS released a 75-page FATCA online registration user guide. It provides instructions for completing the registration process online, including what information is required,

FAQs – FATCA Filing Process (First issued on 06 Feb 2015) Go to the IRS FATCA Registration Portal and create a new account. b) Select the Financial Institution Type, “Sponsoring Entity” and click Next to continue The User Guide is available on the IRAS FATCA webpage. To report an initial registration issue, please email the portal support team at: AEOI_support@mof.gov.kw For general FATCA inquiries, please email the Department for Tax and Planning at FATCA-inquiry@mof.gov.kw Please provide your name and contact details which should include the name of your financial institution.

Find out how to register for the Automatic Exchange of Information (AEOI) service if you're a financial institution. FATCA online registration user guide. On August 19, in conjunction with the portal opening, the IRS released a 75-page FATCA online registration user guide. It provides instructions for completing the registration process online, including what information is required,

FATCA Registration Guide. Tags: FATCA, Register for FATCA, FATCA Registration Guide. The Inland Revenue Division (IRD) FATCA Registration Process grants Financial Institutions (FIs) secure access to perform the following functionality using the online e-Tax System: Submit a FATCA Report; Receive feedback on submitted reports 23.01.2017В В· New FATCA Online Registration User Guide and New QI Account Management System. In December 2016, the IRS published an updated version of the FATCA Online Registration User Guide to assist entities registering with the IRS that replaces the previous version issued in November 2015.

IRS’ Frequently Asked Questions (FAQs) – FATCA

FAQs FATCA Filing Process IRAS. The FATCA Registration Resources Pagecontains information to get you started, including the FATCA Registration Online User Guide, short “how-to” videos for the Registration system, and other resources.If help is needed prior to logging onto the FATCA registration system, the Registration User Guide will provide information about logging in, FATCA Online. Registration. December 2016. Publication 5118 (Rev.12-2016) Catalog Number 65265H Departm... 8 hours ago FATCA Online. Registration. December 2016. Publication 5118 (Rev.12-2016) Catalog Number 65265H Departm Purpose of FATCA Online Registration User Guide.

IRS releases revised FATCA Online Registration User Guide. FATCA Online Registration User Guide 5. Under the Foreign Account Tax Compliance Act (FATCA), withholding agents must withhold tax on certain payments to Foreign Financial Institutions (FFIs) that do not agree to report certain information to the IRS about their U .S . accounts, including the accounts, Financial Institutions with FATCA obligations are able to report the relevant information to us in myIR. You must complete your reporting by 30 June of the relevant tax year. Instructions on how to submit a FATCA disclosure are in the Foreign Account Tax Compliance Act (FATCA) - ….

e-Service Portal FATCA & CRS src.gov.sc

New and Updated FATCA FAQs deloitte.com. To report an initial registration issue, please email the portal support team at: AEOI_support@mof.gov.kw For general FATCA inquiries, please email the Department for Tax and Planning at FATCA-inquiry@mof.gov.kw Please provide your name and contact details which should include the name of your financial institution. https://en.wikipedia.org/wiki/FATCA Foreign Account Tax Compliance Act User Guide. FATCA. Online. Registration. July 2018. Publication 5118 (Rev. 7-2018) Catalog Number 65265H Department of the ….

USER GUIDE. Foreign Account Tax Compliance Act (FATCA) Document No. D 13134 (Rev. 08/2013) Catalog Number 65179U. FATCA Online Registration User Guide CITT News. Navigation. IRS releases revised FATCA Online Registration User Guide. 9. June 2017, Mark D. Orlic Reply. In June 2017, the U.S. Internal Revenue Service (“IRS”) released a revised Publication 5118 Foreign Account Tax Compliance Act Online Registration User Guide .

FATCA Online. Registration. December 2016. Publication 5118 (Rev.12-2016) Catalog Number 65265H Departm... 8 hours ago FATCA Online. Registration. December 2016. Publication 5118 (Rev.12-2016) Catalog Number 65265H Departm Purpose of FATCA Online Registration User Guide IRS opens FATCA online registration system to provide a beneficial user testing period August 20, 2013 In brief The Internal Revenue Service (IRS) announced the opening of the Foreign Account Tax Compliance Act (FATCA) registration system on August 19, 2013. The registration system will enable financial

Financial Institutions with FATCA obligations are able to report the relevant information to us in myIR. You must complete your reporting by 30 June of the relevant tax year. Instructions on how to submit a FATCA disclosure are in the Foreign Account Tax Compliance Act (FATCA) - … Foreign Account Tax Compliance Act User Guide. FATCA. Online. Registration. July 2018. Publication 5118 (Rev. 7-2018) Catalog Number 65265H Department of the …

FATCA Registration for Non-US Credit Unions Last Updated: May 13, 2014 The Internal Revenue Service (IRS), the United States tax authority that is a U.S. Treasury Department bureau, is now accepting online registrations from “Foreign Financial Institutions” FAQs – FATCA Filing Process (First issued on 06 Feb 2015) Go to the IRS FATCA Registration Portal and create a new account. b) Select the Financial Institution Type, “Sponsoring Entity” and click Next to continue The User Guide is available on the IRAS FATCA webpage.

Foreign Account Tax Compliance Act (FATCA) The IRAS Supplementary XML Schema User Guide for Preparing the FATCA Reporting Data File (“Supplementary Guide”) to be read in conjunction with the FATCA Regulations, Reporting SGFIs must provide their FATCA registration information to IRAS. Foreign Account Tax Compliance Act (FATCA) Online Registration User Guide 0718 07/19/2018 Publ 5124: FATCA XML User Guide 0417 04/19/2017 Publ 5147: Foreign Account Tax Compliance Act (FATCA) Foreign Financial Institution (FFI) List Search and Download Tool 1115

Foreign Account Tax Compliance Act (FATCA) The IRAS Supplementary XML Schema User Guide for Preparing the FATCA Reporting Data File (“Supplementary Guide”) to be read in conjunction with the FATCA Regulations, Reporting SGFIs must provide their FATCA registration information to IRAS. The Internal Revenue Service has released an updated version of its “FATCA Online Registration User Guide.” The updates primarily address the newly-released FFI agreement renewal function, which is now available on the IRS FATCA portal and is to be used by foreign financial institutions to …

Foreign Account Tax Compliance Act (FATCA) The IRAS Supplementary XML Schema User Guide for Preparing the FATCA Reporting Data File (“Supplementary Guide”) to be read in conjunction with the FATCA Regulations, Reporting SGFIs must provide their FATCA registration information to IRAS. Publication 5118 Foreign Account Tax Compliance Act (FATCA) Online Registration User Guide: Publication 5147 Foreign Account Tax Compliance Act (FATCA) Foreign Financial Institution (FFI) List Search and Download Tool: Publication 5189 FATCA Reports …

The FATCA Online Registration System needs to contain any updates to contact information for the Responsible Officer and Points of Contact to ensure you receiv. A new version of the IDES User Guide has been pos... FATCA IDES Sample Enveloping Signature File & Updated version of FATCA IDES User Guide. March 5, 2015. 1/8. Please reload. Foreign Account Tax Compliance Act User Guide. FATCA. Online. Registration. July 2018. Publication 5118 (Rev. 7-2018) Catalog Number 65265H Department of the …

24.11.2015 · IRS Upgrades, Enhances FATCA Registration System November 24, 2015 – IR-2015-131 WASHINGTON — The Internal Revenue Service has upgraded the Foreign Account Tax Compliance Act (FATCA) Online Registration System, enabling sponsoring entities to register their sponsored entities to obtain a global intermediary identification number. To report an initial registration issue, please email the portal support team at: AEOI_support@mof.gov.kw For general FATCA inquiries, please email the Department for Tax and Planning at FATCA-inquiry@mof.gov.kw Please provide your name and contact details which should include the name of your financial institution.

Registration Online User Guide (User Guide) that provides step-by-step instructions on the registration process for financial institutions. See these releases and a link to the registration system. A draft version of the form which will be used for reporting information required under FATCA, Form 8966, was issued on … Financial Institutions with FATCA obligations are able to report the relevant information to us in myIR. You must complete your reporting by 30 June of the relevant tax year. Instructions on how to submit a FATCA disclosure are in the Foreign Account Tax Compliance Act (FATCA) - …

The FATCA Registration Resources Pagecontains information to get you started, including the FATCA Registration Online User Guide, short “how-to” videos for the Registration system, and other resources.If help is needed prior to logging onto the FATCA registration system, the Registration User Guide will provide information about logging in The following changes were made to the FATCA Registration System on December 8, 2013. For more detailed information, refer to Appendix A in the updated FATCA Registration Online User Guide. 1. Corrections to reported problems:

1.2 Executing jQuery/JavaScript Coded After the DOM Has Loaded but Before Complete Page Load 10 1.3 Selecting DOM Elements Using Selectors and the jQuery Function 13 1.4 Selecting DOM Elements Within a Specified Context 15 1.5 Filtering a Wrapper Set of DOM Elements 16 Javascript and jquery pdf download Southland 2017-12-17В В· Download free JavaScript eBooks in pdf format or read books online. Books included in this category cover topics related to JavaScript such as Angular, React, React Native, Vue, Node.js, ES6, Typescript, Backbone.js, Knockout.js, Gulp, Webpack, D3, jQuery, Ionic framework, Modular JavaScript, Object-Oriented JavaScript, Bing Maps V8

IT guidance notes for FATCA US and UK reporting

Foreign Account Tax Compliance Act FATCA Online. Documents: The BVI Financial Account Reporting System User Guide; Competent Authority Agreements for Automatic Exchange of Information . Access more information on Automatic Exchange of Information in relation to US FATCA, UK CDOT and CRS, such as Legislation, Inter-Governmental Agreements, Guidance Notes, Self-Certification Forms, Lists of Participating and Reportable Jurisdictions for CRS, Foreign Account Tax Compliance Act (FATCA) The IRAS Supplementary XML Schema User Guide for Preparing the FATCA Reporting Data File (“Supplementary Guide”) to be read in conjunction with the FATCA Regulations, Reporting SGFIs must provide their FATCA registration information to IRAS..

IT guidance notes for FATCA US and UK reporting

New and Updated FATCA FAQs deloitte.com. FATCA Registration for Non-US Credit Unions Last Updated: May 13, 2014 The Internal Revenue Service (IRS), the United States tax authority that is a U.S. Treasury Department bureau, is now accepting online registrations from “Foreign Financial Institutions”, In July 2018, with publication 5118 (Rev-7-2018) the U.S. Internal Revenue Service (“IRS”) released a new version of the Foreign Account Tax Compliance Act (“FATCA”) Online Registration User Guide ().The June 2017 version of the Online Registration User Guide was updated based on the recent changes to the FATCA Online Registration System..

UK FATCAUnder UK FATCA IGA Model 2, those companies designated Foreign Financial Institutions (FFIs) under UK FATCA in Bermuda, will need to report information directly to Her Majesty’s Revenue & Customs (HMRC) in London in order to comply with Section 4A of the Bermuda International Cooperation (Tax Information Exchange Agreements) Act 2005. 12.06.2017 · The Internal Revenue Service has released an updated version of its “FATCA Online Registration User Guide.” The updates primarily address the newly-released FFI agreement renewal...

The following changes were made to the FATCA Registration System on December 8, 2013. For more detailed information, refer to Appendix A in the updated FATCA Registration Online User Guide. 1. Corrections to reported problems: The Internal Revenue Service has released an updated version of its “FATCA Online Registration User Guide.” The updates primarily address the newly-released FFI agreement renewal function, which is now available on the IRS FATCA portal and is to be used by foreign financial institutions to …

21.08.2013 · By Professor William Byrnes, - co-author of LexisNexis® Guide to FATCA Compliance; co-author of Foreign Tax & Trade Briefs. FATCA Registration Portal Open for Business. FATCA requires that FFIs, through a responsible officer (a.k.a. “FATCA compliance officer”), make regular certifications to the IRS via the FATCA Portal, as well as annually disclose taxpayer and account information for U The Internal Revenue Service has released an updated version of its “FATCA Online Registration User Guide.” The updates primarily address the newly-released FFI agreement renewal function, which is now available on the IRS FATCA portal and is to be used by foreign financial institutions to …

The Internal Revenue Service has released an updated version of its “FATCA Online Registration User Guide.” The updates primarily address the newly-released FFI agreement renewal function, which is now available on the IRS FATCA portal and is to be used by foreign financial institutions to … Financial Institutions with FATCA obligations are able to report the relevant information to us in myIR. You must complete your reporting by 30 June of the relevant tax year. Instructions on how to submit a FATCA disclosure are in the Foreign Account Tax Compliance Act (FATCA) - …

21.08.2013 · By Professor William Byrnes, - co-author of LexisNexis® Guide to FATCA Compliance; co-author of Foreign Tax & Trade Briefs. FATCA Registration Portal Open for Business. FATCA requires that FFIs, through a responsible officer (a.k.a. “FATCA compliance officer”), make regular certifications to the IRS via the FATCA Portal, as well as annually disclose taxpayer and account information for U Foreign Account Tax Compliance Act (FATCA) The IRAS Supplementary XML Schema User Guide for Preparing the FATCA Reporting Data File (“Supplementary Guide”) to be read in conjunction with the FATCA Regulations, Reporting SGFIs must provide their FATCA registration information to IRAS.

International Data Exchange Service (IDES) - Knowledge Base International Data Exchange Service (IDES) - Knowledge Base (PDF) FATCA User Guide Frequently Asked Questions: IDES Frequently Asked Questions Additional FAQs are available for FATCA - FAQs … FATCA online registration user guide. On August 19, in conjunction with the portal opening, the IRS released a 75-page FATCA online registration user guide. It provides instructions for completing the registration process online, including what information is required,

Foreign Account Tax Compliance Act (FATCA) The IRAS Supplementary XML Schema User Guide for Preparing the FATCA Reporting Data File (“Supplementary Guide”) to be read in conjunction with the FATCA Regulations, Reporting SGFIs must provide their FATCA registration information to IRAS. 21.08.2013 · By Professor William Byrnes, - co-author of LexisNexis® Guide to FATCA Compliance; co-author of Foreign Tax & Trade Briefs. FATCA Registration Portal Open for Business. FATCA requires that FFIs, through a responsible officer (a.k.a. “FATCA compliance officer”), make regular certifications to the IRS via the FATCA Portal, as well as annually disclose taxpayer and account information for U

FATCA online registration user guide. On August 19, in conjunction with the portal opening, the IRS released a 75-page FATCA online registration user guide. It provides instructions for completing the registration process online, including what information is required, IT guidance notes for FATCA: US and UK reporting 3 If your registration is successful, we will send you an email containing an activation PIN code and the link to the online portal. If your registration is rejected, we will send you an email advising you of the reason. AEOI online portal website FI online user management

To report an initial registration issue, please email the portal support team at: AEOI_support@mof.gov.kw For general FATCA inquiries, please email the Department for Tax and Planning at FATCA-inquiry@mof.gov.kw Please provide your name and contact details which should include the name of your financial institution. The purpose of this User Guide is to provide a simple вЂhow-to’ guide of the most commonly used functionalities in the AEOI Portal with respect to FI’s meeting their Notification (registration) and Reporting requirements. This User Guide is not intended to provide business or policy/regulatory guidance to FI’s; it includes only

The following changes were made to the FATCA Registration System on December 8, 2013. For more detailed information, refer to Appendix A in the updated FATCA Registration Online User Guide. 1. Corrections to reported problems: What is the FATCA Online Registration User Guide? A highly detailed, useful guide that provides instructions for completing the registration process online, including what information is required, how registration will vary depending on the type of FI and step-by …

IRS Updates FATCA User Guide OVDPLAW.COM

Foreign Account Tax Compliance Act FATCA Online. What is the Foreign Account Tax Compliance Act (FATCA)? FATCA is an information sharing agreement between Ireland and the United States of America.In December 2012, both countries agreed to exchange financial account information supplied by Irish and United States (US) financial institutions., What is the Foreign Account Tax Compliance Act (FATCA)? FATCA is an information sharing agreement between Ireland and the United States of America.In December 2012, both countries agreed to exchange financial account information supplied by Irish and United States (US) financial institutions..

Foreign Financial Institutions in FATCA Need to Check. updated ICMM Notification User documents (вЂICMM Notifications User Guide,’ вЂICMM Notification XML Schema User Guide,’ and ICMM Electronic Field Errors Table) and the addition of new ICMM Frequently Asked Questions. The specifics of the updates and changes to these documents are outlined below. ICMM Notifications User Guide Two sections, Publication 5118 Foreign Account Tax Compliance Act (FATCA) Online Registration User Guide: Publication 5147 Foreign Account Tax Compliance Act (FATCA) Foreign Financial Institution (FFI) List Search and Download Tool: Publication 5189 FATCA Reports ….

IRS opens online FATCA registration system for financial

FATCA Registration for Non-US Credit Unions. CITT News. Navigation. IRS releases revised FATCA Online Registration User Guide. 9. June 2017, Mark D. Orlic Reply. In June 2017, the U.S. Internal Revenue Service (“IRS”) released a revised Publication 5118 Foreign Account Tax Compliance Act Online Registration User Guide . https://en.wikipedia.org/wiki/FATCA The User Guide is over 100 pages and provides instructions for completing the registration process online, including the information required, how registration will vary depending on the type of financial institution, and step-by-step guidance for answering each question..

updated ICMM Notification User documents (вЂICMM Notifications User Guide,’ вЂICMM Notification XML Schema User Guide,’ and ICMM Electronic Field Errors Table) and the addition of new ICMM Frequently Asked Questions. The specifics of the updates and changes to these documents are outlined below. ICMM Notifications User Guide Two sections The User Guide is over 100 pages and provides instructions for completing the registration process online, including the information required, how registration will vary depending on the type of financial institution, and step-by-step guidance for answering each question.

Helpful materials, including a detailed 75-page FATCA Online Registration User Guide and other FATCA Registration Resources and Support Information, can be found here. We will provide you with an in-depth look at the guidance and the registration process in the near future. Please watch for it. Publication 5118 Foreign Account Tax Compliance Act (FATCA) Online Registration User Guide: Publication 5147 Foreign Account Tax Compliance Act (FATCA) Foreign Financial Institution (FFI) List Search and Download Tool: Publication 5189 FATCA Reports …

FATCA Online Registration User Guide 5. Under the Foreign Account Tax Compliance Act (FATCA), withholding agents must withhold tax on certain payments to Foreign Financial Institutions (FFIs) that do not agree to report certain information to the IRS about their U .S . accounts, including the accounts Documents: The BVI Financial Account Reporting System User Guide; Competent Authority Agreements for Automatic Exchange of Information . Access more information on Automatic Exchange of Information in relation to US FATCA, UK CDOT and CRS, such as Legislation, Inter-Governmental Agreements, Guidance Notes, Self-Certification Forms, Lists of Participating and Reportable Jurisdictions for CRS

FAQs – FATCA Filing Process (First issued on 06 Feb 2015) Go to the IRS FATCA Registration Portal and create a new account. b) Select the Financial Institution Type, “Sponsoring Entity” and click Next to continue The User Guide is available on the IRAS FATCA webpage. Foreign Account Tax Compliance Act User Guide. FATCA. Online. Registration. July 2018. Publication 5118 (Rev. 7-2018) Catalog Number 65265H Department of the …

FATCA online registration user guide. On August 19, in conjunction with the portal opening, the IRS released a 75-page FATCA online registration user guide. It provides instructions for completing the registration process online, including what information is required, 12.06.2017 · The Internal Revenue Service has released an updated version of its “FATCA Online Registration User Guide.” The updates primarily address the newly-released FFI agreement renewal...

FATCA Online Registration User Guide 5. Under the Foreign Account Tax Compliance Act (FATCA), withholding agents must withhold tax on certain payments to Foreign Financial Institutions (FFIs) that do not agree to report certain information to the IRS about their U .S . accounts, including the accounts Registration Online User Guide (User Guide) that provides step-by-step instructions on the registration process for financial institutions. See these releases and a link to the registration system. A draft version of the form which will be used for reporting information required under FATCA, Form 8966, was issued on …

The FATCA Registration Resources Pagecontains information to get you started, including the FATCA Registration Online User Guide, short “how-to” videos for the Registration system, and other resources.If help is needed prior to logging onto the FATCA registration system, the Registration User Guide will provide information about logging in FATCA Registration for Non-US Credit Unions Last Updated: May 13, 2014 The Internal Revenue Service (IRS), the United States tax authority that is a U.S. Treasury Department bureau, is now accepting online registrations from “Foreign Financial Institutions”

Documents: The BVI Financial Account Reporting System User Guide; Competent Authority Agreements for Automatic Exchange of Information . Access more information on Automatic Exchange of Information in relation to US FATCA, UK CDOT and CRS, such as Legislation, Inter-Governmental Agreements, Guidance Notes, Self-Certification Forms, Lists of Participating and Reportable Jurisdictions for CRS FATCA Registration for Non-US Credit Unions Last Updated: May 13, 2014 The Internal Revenue Service (IRS), the United States tax authority that is a U.S. Treasury Department bureau, is now accepting online registrations from “Foreign Financial Institutions”

FATCA Online Registration User Guide 5. Under the Foreign Account Tax Compliance Act (FATCA), withholding agents must withhold tax on certain payments to Foreign Financial Institutions (FFIs) that do not agree to report certain information to the IRS about their U .S . accounts, including the accounts Documents: The BVI Financial Account Reporting System User Guide; Competent Authority Agreements for Automatic Exchange of Information . Access more information on Automatic Exchange of Information in relation to US FATCA, UK CDOT and CRS, such as Legislation, Inter-Governmental Agreements, Guidance Notes, Self-Certification Forms, Lists of Participating and Reportable Jurisdictions for CRS

IT guidance notes for FATCA: US and UK reporting 3 If your registration is successful, we will send you an email containing an activation PIN code and the link to the online portal. If your registration is rejected, we will send you an email advising you of the reason. AEOI online portal website FI online user management Publication 5118 Foreign Account Tax Compliance Act (FATCA) Online Registration User Guide: Publication 5147 Foreign Account Tax Compliance Act (FATCA) Foreign Financial Institution (FFI) List Search and Download Tool: Publication 5189 FATCA Reports …

Helpful materials, including a detailed 75-page FATCA Online Registration User Guide and other FATCA Registration Resources and Support Information, can be found here. We will provide you with an in-depth look at the guidance and the registration process in the near future. Please watch for it. What is the Foreign Account Tax Compliance Act (FATCA)? FATCA is an information sharing agreement between Ireland and the United States of America.In December 2012, both countries agreed to exchange financial account information supplied by Irish and United States (US) financial institutions.