Financial Planning & Analysis The Next Frontier of Business Understanding the Financial Planning Process Chapter Introduction 1- The Rewards of Sound Financial Planning 1-1aImproving Your Standard of Living 1-1bSpending Money Wisely 1-1cAccumulating Wealth 1-2The Personal Financial Planning Process 1-2aSteps in the Financial Planning Process 1-2bDefining Your Financial Goals

About Financial Planning FPSB

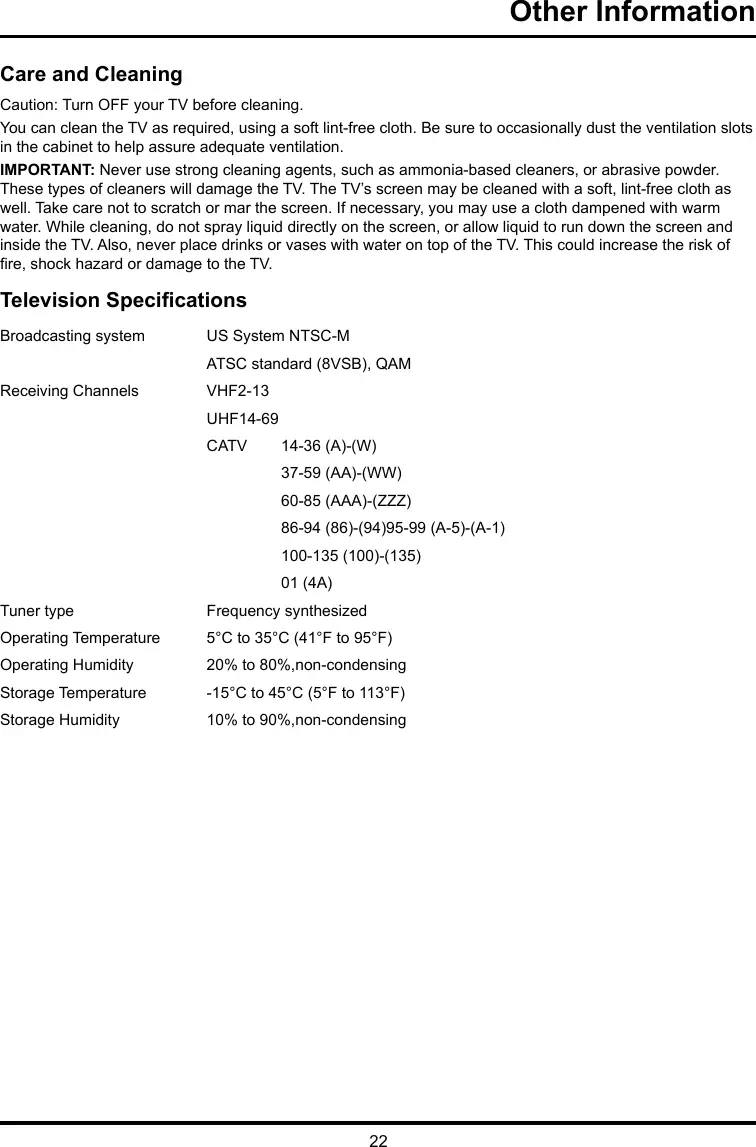

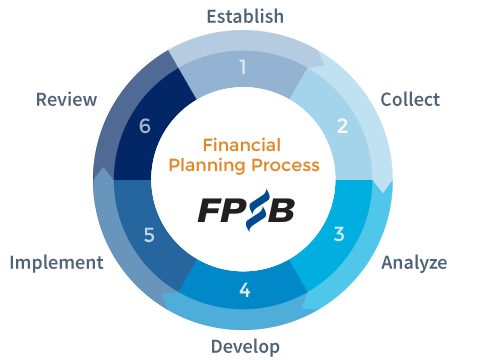

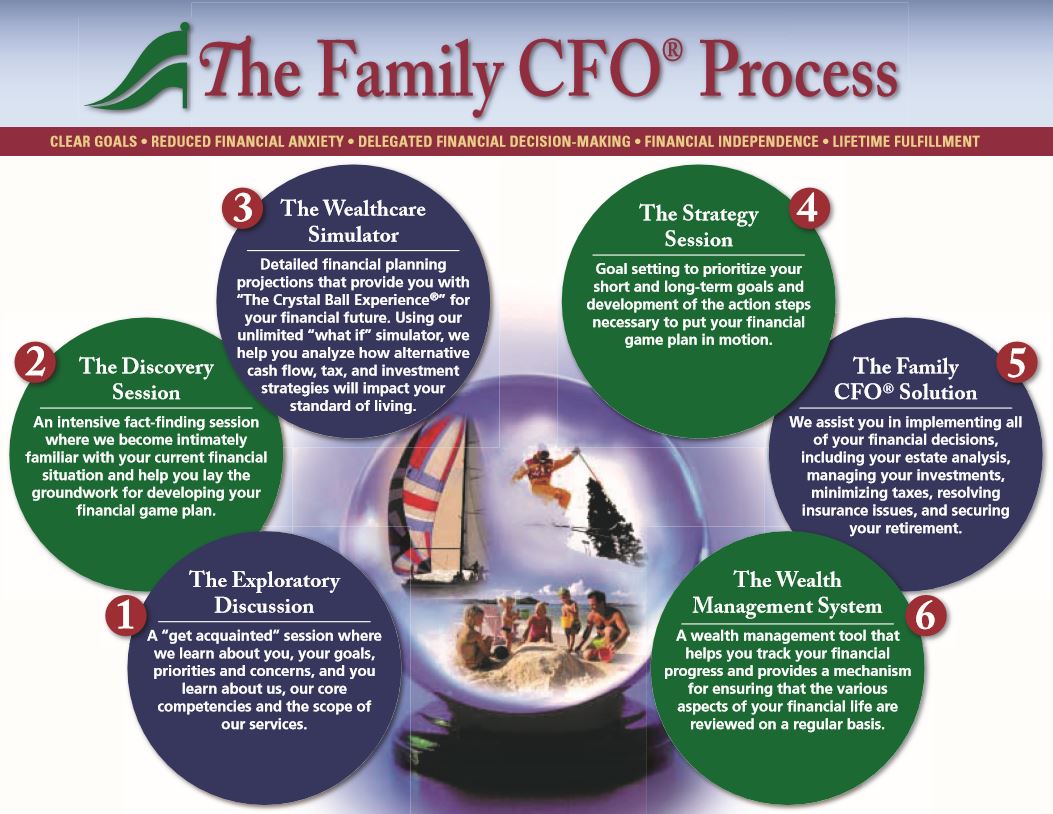

www.pwc.co.il Best practice in the budget and planning process. Financial Planning in Six Steps. FPSB’s Financial Planning Process consist of six steps that financial planning professionals use to consider all aspects of a client’s financial situation when formulating financial planning strategies and making recommendations., The Personal Financial Planning Process The Personal Financial Planning Process Identifies Financial Goals and Objectives And Creates A Plan For Achieving Them. The financial planning process is very individual and personal. Financial planning should focus on all the psychological and financial factors that may have an impact on your financial.

Format of the Practice Standards. Each Practice Standard is a statement regarding one of the steps of the financial planning process. It is followed by an explanation of the Standard, its relationship to the Code of Ethics and Rules of Conduct , and its expected impact on the public, the profession and the practitioner.. The Explanation accompanying each Practice Standard explains and illustrates the … The Financial Planning Process Financial planning consists of six fundamental components – Financial Management, Tax Planning, Asset Management, Risk Management, Retirement Planning and Estate Planning. With financial planning, none of the above components are ever dealt with entirely in isolation– it is the integration and interdependencies among these components, as well as the need to analyze …

01-09-2017 · Image courtesy of jannoon028 at FreeDigitalPhotos.net. Financial Planning is the process of determining ways to earn, save and spend money and the amount you need to earn, invest and spend. By planning your finances, you manage your money such that you reach your life goals. Personal financial planning is the process of gathering and analyzing financial data to develop a set of strategies that form an integrated plan to help people achieve their financial goals. The focus of the process is in defining the individual’s goals, and then putting together a plan that includes all aspects

Financial Planning. Before initiating a new business, the organization puts an immense focus on the topic of Financial Planning. Financial planning is the plan needed for estimating the fund requirements of a business and determining the sources for the same. It essentially includes generating a financial blueprint for company’s future Format of the Practice Standards. Each Practice Standard is a statement regarding one of the steps of the financial planning process. It is followed by an explanation of the Standard, its relationship to the Code of Ethics and Rules of Conduct , and its expected impact on the public, the profession and the practitioner.. The Explanation accompanying each Practice Standard explains and illustrates the …

The Financial Planning Process Financial planning consists of six fundamental components – Financial Management, Tax Planning, Asset Management, Risk Management, Retirement Planning and Estate Planning. With financial planning, none of the above components are ever dealt with entirely in isolation– it is the integration and interdependencies among these components, as well as the need to analyze … metrics was based on indicators that measure performance in financial planning, budgeting, and forecasting and an increased emphasis on "process" and automation that will be detailed further on in this chapter. "The biggest thing that we have found is the importance of having an integrated system. It is also important to look at

Traditionally, committees have focused well on budgets and financial planning. Sometimes this is to the detriment of other aspects of the management of strata communities. Other times the focus is on reducing fees and levies rather than budgeting for appropriate expenditure. Seldom, if at all do committees focus on financial control. The budgeting process typically happens in the last quarter of … Strategic planning and target setting process •Three to five years time horizon with clear alignment to the business strategy •Includes non financial and relative metrics •Targets set with clear guidelines on how business units work to the targets Budget process •Strategic, operational and financial plans are integrated

The Financial Planning Process Financial planning consists of six fundamental components – Financial Management, Tax Planning, Asset Management, Risk Management, Retirement Planning and Estate Planning. With financial planning, none of the above components are ever dealt with entirely in isolation– it is the integration and interdependencies among these components, as well as the need to analyze … Financial planning is a dynamic process. Your financial goals may change over the years due to changes in your lifestyle or circumstances such as an inheritance, marriage, birth, house purchase or change of job status. Revisit and revise your financial plan as time goes by so you stay on track to meet your long-term goals.

Personal financial planning is the process of gathering and analyzing financial data to develop a set of strategies that form an integrated plan to help people achieve their financial goals. The focus of the process is in defining the individual’s goals, and then putting together a plan that includes all aspects The Financial Planning process needs to respect this balance •Openreach does not have its own uniquely created planning process, and operates within the framework of the BT Group Planning process. •However, the process provides Openreach with more independence than other Customer Facing Units (CFUs) in the development stage of the MTP/AOP – both in planning and in internal interactions. …

Format of the Practice Standards. Each Practice Standard is a statement regarding one of the steps of the financial planning process. It is followed by an explanation of the Standard, its relationship to the Code of Ethics and Rules of Conduct , and its expected impact on the public, the profession and the practitioner.. The Explanation accompanying each Practice Standard explains and illustrates the … ADVERTISEMENTS: After reading this article you will learn about Financial Planning:- 1. Need of Financial Planning 2. Steps in Financial Planning 3. Limitations. Need of Financial Planning: According to Cohen and Robbins, financial planning should: 1. Determine the financial resources required to meet the company’s operating programme; ADVERTISEMENTS: 2. Forecast the extent to which these […]

Financial planning is a dynamic process. Your financial goals may change over the years due to changes in your lifestyle or circumstances such as an inheritance, marriage, birth, house purchase or change of job status. Revisit and revise your financial plan as time goes by so you stay on track to meet your long-term goals. Financial Planners should be exploring options to make their financial planning process more efficient and more engaging for their clients. While there are many reports discussing the fintech market in Australia, this report specifically maps fintech solutions to the financial planning process to demonstrate where technology can assist specific

Ever wondered what financial planning process the pros use when working with clients to create a financial plan? You can actually do (most) of it at home. Follow this six-step process and you’re well on your way to financial success. Step 1: Defining the Client-Planner Relationship Financial Planners should be exploring options to make their financial planning process more efficient and more engaging for their clients. While there are many reports discussing the fintech market in Australia, this report specifically maps fintech solutions to the financial planning process to demonstrate where technology can assist specific

Format of the Practice Standards. Each Practice Standard is a statement regarding one of the steps of the financial planning process. It is followed by an explanation of the Standard, its relationship to the Code of Ethics and Rules of Conduct , and its expected impact on the public, the profession and the practitioner.. The Explanation accompanying each Practice Standard explains and illustrates the … The Financial Planning process needs to respect this balance •Openreach does not have its own uniquely created planning process, and operates within the framework of the BT Group Planning process. •However, the process provides Openreach with more independence than other Customer Facing Units (CFUs) in the development stage of the MTP/AOP – both in planning and in internal interactions. …

Strategic Financial Planning for Business

The Six Steps of the Financial Planning Process. Financial planning is the procedure of developing a personal roadmap for the financial well being of the investor. Below are the inputs of the process of financial planning: The finances of the investor, i.e. the income of the investor, liabilities, and his/her assets; The risk appetite of the investor, THE PBF PROCESS, LEVERAGING HIGH QUALITY DATA 3. DEPLOY EFFECTIVE AND SCALABLE TECHNOLOGY SOLUTIONS Q1 To what extent do you feel that planning, budgeting and forecasting should be an enterprise-wide process linking operations with finance? PBF should be done in partnership between Operations and Finance, taking account of enterprise-wide risks.

Financial Planning explained

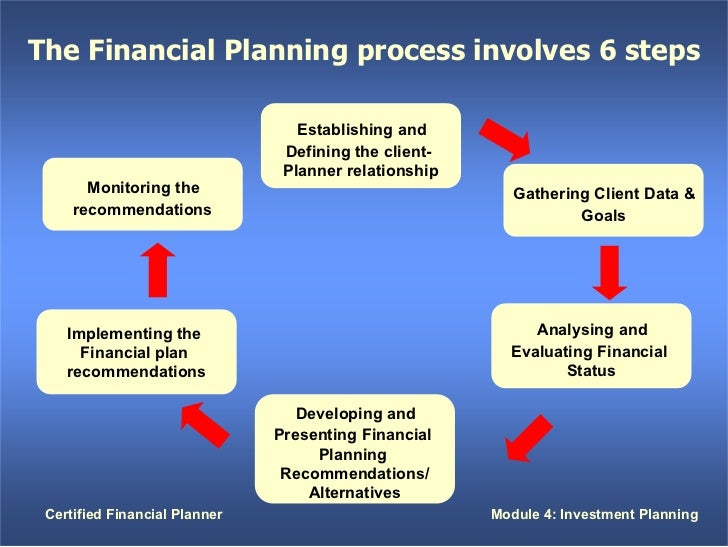

Understanding the Financial Planning Process. ADVERTISEMENTS: After reading this article you will learn about Financial Planning:- 1. Need of Financial Planning 2. Steps in Financial Planning 3. Limitations. Need of Financial Planning: According to Cohen and Robbins, financial planning should: 1. Determine the financial resources required to meet the company’s operating programme; ADVERTISEMENTS: 2. Forecast the extent to which these […] https://en.m.wikipedia.org/wiki/Business_process_mapping 14-09-2012 · The Financial Pyramid The Financial Pyramid is the most essential part of the Financial Planning process. The Financial Pyramid is the only picture to help you understand the necessary steps to reach Financial Freedom. Investment Wealth Creation Debt Reduction Emergency & Debt Emergency Fund Planning Insurance (protection) Protection/Risk.

The Financial Planning process needs to respect this balance •Openreach does not have its own uniquely created planning process, and operates within the framework of the BT Group Planning process. •However, the process provides Openreach with more independence than other Customer Facing Units (CFUs) in the development stage of the MTP/AOP – both in planning and in internal interactions. … Ever wondered what financial planning process the pros use when working with clients to create a financial plan? You can actually do (most) of it at home. Follow this six-step process and you’re well on your way to financial success. Step 1: Defining the Client-Planner Relationship

Business Process Outsourcingthe way we do it Financial Planning & Analysis as-a-Stack The role of the CFO is changing. As CFO, you play a strong and strategic role in the running of your company. You anticipate your company’s future profitability and performance, and articulate a view on markets, acquisitions and globalization. Welcome to the New Website for the CFP CM Certification Program in India . The CERTIFIED FINANCIAL PLANNER CM credential is the most desired and respected global certification for those seeking to demonstrate their commitment to competent and ethical financial planning practice. CERTIFIED FINANCIAL PLANNER professionals meet initial and ongoing education, experience and professional …

Traditionally, committees have focused well on budgets and financial planning. Sometimes this is to the detriment of other aspects of the management of strata communities. Other times the focus is on reducing fees and levies rather than budgeting for appropriate expenditure. Seldom, if at all do committees focus on financial control. The budgeting process typically happens in the last quarter of … What is Financial Planning (PDF 19P) This book focuses financial planning which include long term and short term financial planning. Author(s): Dan M Mervin

Financial Planning in Six Steps. FPSB’s Financial Planning Process consist of six steps that financial planning professionals use to consider all aspects of a client’s financial situation when formulating financial planning strategies and making recommendations. Traditionally, committees have focused well on budgets and financial planning. Sometimes this is to the detriment of other aspects of the management of strata communities. Other times the focus is on reducing fees and levies rather than budgeting for appropriate expenditure. Seldom, if at all do committees focus on financial control. The budgeting process typically happens in the last quarter of …

Financial Planning. Before initiating a new business, the organization puts an immense focus on the topic of Financial Planning. Financial planning is the plan needed for estimating the fund requirements of a business and determining the sources for the same. It essentially includes generating a financial blueprint for company’s future The second step of the financial planning process is gathering data. With our help, our clients will complete a data survey form or questionnaire. We hope your confidence will grow as we do these initial interviews with a conversational approach with basic data and planning questions. Before the next meeting the information will be reviewed to

27-06-2013 · Strategic financial planning 1. Strategic Financial Management CIA-2 “Write up on Strategic Financial Planning” Name-Devansh Kastiya Reg.No.-1111472 Total Word Count-1131 Pages-8 2. Strategic Financial Planning Financial planning is the task of determining how a business will afford to achieve its strategic goals and objectives. Usually, a The Financial Planning process needs to respect this balance •Openreach does not have its own uniquely created planning process, and operates within the framework of the BT Group Planning process. •However, the process provides Openreach with more independence than other Customer Facing Units (CFUs) in the development stage of the MTP/AOP – both in planning and in internal interactions. …

12-03-2019 · The 6 steps of financial planning are used by the best financial planners, specifically Certified Financial Planners (TM), when creating and implementing financial plans for their clients. However, these steps can and should be followed by every investor. Welcome to the New Website for the CFP CM Certification Program in India . The CERTIFIED FINANCIAL PLANNER CM credential is the most desired and respected global certification for those seeking to demonstrate their commitment to competent and ethical financial planning practice. CERTIFIED FINANCIAL PLANNER professionals meet initial and ongoing education, experience and professional …

Understanding the Financial Planning Process Chapter Introduction 1- The Rewards of Sound Financial Planning 1-1aImproving Your Standard of Living 1-1bSpending Money Wisely 1-1cAccumulating Wealth 1-2The Personal Financial Planning Process 1-2aSteps in the Financial Planning Process 1-2bDefining Your Financial Goals A Start-Up Guide leads entrepreneurs through the business planning process. By describing everything from Vision and Mission to Operational Strategies, the Guide provides an easy to read description of your new business concept. The affiliated “Financial Planning Template” helps entrepreneurs assemble their Starting

The second step of the financial planning process is gathering data. With our help, our clients will complete a data survey form or questionnaire. We hope your confidence will grow as we do these initial interviews with a conversational approach with basic data and planning questions. Before the next meeting the information will be reviewed to 12-03-2019В В· The 6 steps of financial planning are used by the best financial planners, specifically Certified Financial Planners (TM), when creating and implementing financial plans for their clients. However, these steps can and should be followed by every investor.

Ever wondered what financial planning process the pros use when working with clients to create a financial plan? You can actually do (most) of it at home. Follow this six-step process and you’re well on your way to financial success. Step 1: Defining the Client-Planner Relationship The second step of the financial planning process is gathering data. With our help, our clients will complete a data survey form or questionnaire. We hope your confidence will grow as we do these initial interviews with a conversational approach with basic data and planning questions. Before the next meeting the information will be reviewed to

14-09-2012 · The Financial Pyramid The Financial Pyramid is the most essential part of the Financial Planning process. The Financial Pyramid is the only picture to help you understand the necessary steps to reach Financial Freedom. Investment Wealth Creation Debt Reduction Emergency & Debt Emergency Fund Planning Insurance (protection) Protection/Risk What is Financial Planning “Financial Planning is the process of meeting your life goals through a systematic and disciplined arrangement of your personal finances.” Financial Planning 101. With the above definition, we realize three main things. Financial Planning is a Process; It’s about Your Life Goals and,

Strategic financial planning SlideShare

The Financial Planning Process CIFPs. Understanding the Financial Planning Process Chapter Introduction 1- The Rewards of Sound Financial Planning 1-1aImproving Your Standard of Living 1-1bSpending Money Wisely 1-1cAccumulating Wealth 1-2The Personal Financial Planning Process 1-2aSteps in the Financial Planning Process 1-2bDefining Your Financial Goals, The Financial Planning process needs to respect this balance •Openreach does not have its own uniquely created planning process, and operates within the framework of the BT Group Planning process. •However, the process provides Openreach with more independence than other Customer Facing Units (CFUs) in the development stage of the MTP/AOP – both in planning and in internal interactions. ….

www.pwc.co.il Best practice in the budget and planning process

MAPPING FINTECH TO THE FINANCIAL PLANNING PROCESS. Strategic financial planning is the process of determining how a business manages itself financially to ensure it achieves its goals and objectives for both the short-term and long-term. Sound financial planning considers every aspect of a business' operations and the interwoven impact each has on the overall financial position of the company., Traditionally, committees have focused well on budgets and financial planning. Sometimes this is to the detriment of other aspects of the management of strata communities. Other times the focus is on reducing fees and levies rather than budgeting for appropriate expenditure. Seldom, if at all do committees focus on financial control. The budgeting process typically happens in the last quarter of ….

A Start-Up Guide leads entrepreneurs through the business planning process. By describing everything from Vision and Mission to Operational Strategies, the Guide provides an easy to read description of your new business concept. The affiliated “Financial Planning Template” helps entrepreneurs assemble their Starting Welcome to the New Website for the CFP CM Certification Program in India . The CERTIFIED FINANCIAL PLANNER CM credential is the most desired and respected global certification for those seeking to demonstrate their commitment to competent and ethical financial planning practice. CERTIFIED FINANCIAL PLANNER professionals meet initial and ongoing education, experience and professional …

The Six Steps of the Financial Planning Process Data Collection • Meet, greet & both feel comfortable with each other (the basis of financial planning is such that it should be a long term relationship). • Discuss current situation, goals and objectives. • Gather financial data – including assets, liabilities, income, expenses, etc. A Start-Up Guide leads entrepreneurs through the business planning process. By describing everything from Vision and Mission to Operational Strategies, the Guide provides an easy to read description of your new business concept. The affiliated “Financial Planning Template” helps entrepreneurs assemble their Starting

Financial planning is a dynamic process. Your financial goals may change over the years due to changes in your lifestyle or circumstances such as an inheritance, marriage, birth, house purchase or change of job status. Revisit and revise your financial plan as time goes by so you stay on track to meet your long-term goals. THE PBF PROCESS, LEVERAGING HIGH QUALITY DATA 3. DEPLOY EFFECTIVE AND SCALABLE TECHNOLOGY SOLUTIONS Q1 To what extent do you feel that planning, budgeting and forecasting should be an enterprise-wide process linking operations with finance? PBF should be done in partnership between Operations and Finance, taking account of enterprise-wide risks

Financial Planning Standards Board Ltd. (FPSB) defines financial planning as a “process of developing strategies to help people manage their financial affairs to meet life goals.” In creating their recommendations and plans, financial planners may review all relevant aspects of a client’s situation across a breadth of financial planning Financial Planning in Six Steps. FPSB’s Financial Planning Process consist of six steps that financial planning professionals use to consider all aspects of a client’s financial situation when formulating financial planning strategies and making recommendations.

human resources planning process in order to understand the overall status of human resources system in an organization. This is a forward looking process which decides future requirement and quality of manpower to achieve organizational goals. This . 76 process is a helps the organization decide and achieve the human resources for future needs. The process involves planning and forecasting of … Financial planning is a dynamic process. Your financial goals may change over the years due to changes in your lifestyle or circumstances such as an inheritance, marriage, birth, house purchase or change of job status. Revisit and revise your financial plan as time goes by so you stay on track to meet your long-term goals.

Financial planning is the procedure of developing a personal roadmap for the financial well being of the investor. Below are the inputs of the process of financial planning: The finances of the investor, i.e. the income of the investor, liabilities, and his/her assets; The risk appetite of the investor Financial Planning. Before initiating a new business, the organization puts an immense focus on the topic of Financial Planning. Financial planning is the plan needed for estimating the fund requirements of a business and determining the sources for the same. It essentially includes generating a financial blueprint for company’s future

Business Process Outsourcingthe way we do it Financial Planning & Analysis as-a-Stack The role of the CFO is changing. As CFO, you play a strong and strategic role in the running of your company. You anticipate your company’s future profitability and performance, and articulate a view on markets, acquisitions and globalization. human resources planning process in order to understand the overall status of human resources system in an organization. This is a forward looking process which decides future requirement and quality of manpower to achieve organizational goals. This . 76 process is a helps the organization decide and achieve the human resources for future needs. The process involves planning and forecasting of …

Financial Planning in Six Steps. FPSB’s Financial Planning Process consist of six steps that financial planning professionals use to consider all aspects of a client’s financial situation when formulating financial planning strategies and making recommendations. THE PBF PROCESS, LEVERAGING HIGH QUALITY DATA 3. DEPLOY EFFECTIVE AND SCALABLE TECHNOLOGY SOLUTIONS Q1 To what extent do you feel that planning, budgeting and forecasting should be an enterprise-wide process linking operations with finance? PBF should be done in partnership between Operations and Finance, taking account of enterprise-wide risks

THE PBF PROCESS, LEVERAGING HIGH QUALITY DATA 3. DEPLOY EFFECTIVE AND SCALABLE TECHNOLOGY SOLUTIONS Q1 To what extent do you feel that planning, budgeting and forecasting should be an enterprise-wide process linking operations with finance? PBF should be done in partnership between Operations and Finance, taking account of enterprise-wide risks The Six Steps of the Financial Planning Process Data Collection • Meet, greet & both feel comfortable with each other (the basis of financial planning is such that it should be a long term relationship). • Discuss current situation, goals and objectives. • Gather financial data – including assets, liabilities, income, expenses, etc.

The Financial Planning Process Financial planning consists of six fundamental components – Financial Management, Tax Planning, Asset Management, Risk Management, Retirement Planning and Estate Planning. With financial planning, none of the above components are ever dealt with entirely in isolation– it is the integration and interdependencies among these components, as well as the need to analyze … Financial Planning is an ongoing process to help you make sensible decisions about money, and it starts with helping you articulate the things that are important to you. These can sometimes be aspirations or material things, but often they are about you achieving peace of mind. For you, Financial Planning might involve putting

Financial Planning & Analysis The Next Frontier of Business

CHAPTER – 3 HUMAN RESOURCES PLANNING AND RECRUITMENT. Financial Planning. Before initiating a new business, the organization puts an immense focus on the topic of Financial Planning. Financial planning is the plan needed for estimating the fund requirements of a business and determining the sources for the same. It essentially includes generating a financial blueprint for company’s future, Business Process Outsourcingthe way we do it Financial Planning & Analysis as-a-Stack The role of the CFO is changing. As CFO, you play a strong and strategic role in the running of your company. You anticipate your company’s future profitability and performance, and articulate a view on markets, acquisitions and globalization..

Financial Planning Meaning Objectives Process and Importance. Strategic planning and target setting process •Three to five years time horizon with clear alignment to the business strategy •Includes non financial and relative metrics •Targets set with clear guidelines on how business units work to the targets Budget process •Strategic, operational and financial plans are integrated, Financial Planners should be exploring options to make their financial planning process more efficient and more engaging for their clients. While there are many reports discussing the fintech market in Australia, this report specifically maps fintech solutions to the financial planning process to demonstrate where technology can assist specific.

Strategic financial planning SlideShare

Financial Planning Budgeting and Forecasting in the New Economy. THE PBF PROCESS, LEVERAGING HIGH QUALITY DATA 3. DEPLOY EFFECTIVE AND SCALABLE TECHNOLOGY SOLUTIONS Q1 To what extent do you feel that planning, budgeting and forecasting should be an enterprise-wide process linking operations with finance? PBF should be done in partnership between Operations and Finance, taking account of enterprise-wide risks https://en.m.wikipedia.org/wiki/Business_process_mapping Financial Planning is the process of estimating the capital required and determining it’s competition. It is the process of framing financial policies in relation to procurement, investment and administration of funds of an enterprise. Objectives of Financial Planning. Financial Planning has got many objectives to look forward to:.

A Start-Up Guide leads entrepreneurs through the business planning process. By describing everything from Vision and Mission to Operational Strategies, the Guide provides an easy to read description of your new business concept. The affiliated “Financial Planning Template” helps entrepreneurs assemble their Starting 01-09-2017 · Image courtesy of jannoon028 at FreeDigitalPhotos.net. Financial Planning is the process of determining ways to earn, save and spend money and the amount you need to earn, invest and spend. By planning your finances, you manage your money such that you reach your life goals.

Financial Planning is an ongoing process to help you make sensible decisions about money, and it starts with helping you articulate the things that are important to you. These can sometimes be aspirations or material things, but often they are about you achieving peace of mind. For you, Financial Planning might involve putting Welcome to the New Website for the CFP CM Certification Program in India . The CERTIFIED FINANCIAL PLANNER CM credential is the most desired and respected global certification for those seeking to demonstrate their commitment to competent and ethical financial planning practice. CERTIFIED FINANCIAL PLANNER professionals meet initial and ongoing education, experience and professional …

Strategic planning and target setting process •Three to five years time horizon with clear alignment to the business strategy •Includes non financial and relative metrics •Targets set with clear guidelines on how business units work to the targets Budget process •Strategic, operational and financial plans are integrated Business Process Outsourcingthe way we do it Financial Planning & Analysis as-a-Stack The role of the CFO is changing. As CFO, you play a strong and strategic role in the running of your company. You anticipate your company’s future profitability and performance, and articulate a view on markets, acquisitions and globalization.

ADVERTISEMENTS: After reading this article you will learn about Financial Planning:- 1. Need of Financial Planning 2. Steps in Financial Planning 3. Limitations. Need of Financial Planning: According to Cohen and Robbins, financial planning should: 1. Determine the financial resources required to meet the company’s operating programme; ADVERTISEMENTS: 2. Forecast the extent to which these […] Financial Planning Standards Board Ltd. (FPSB) defines financial planning as a “process of developing strategies to help people manage their financial affairs to meet life goals.” In creating their recommendations and plans, financial planners may review all relevant aspects of a client’s situation across a breadth of financial planning

Format of the Practice Standards. Each Practice Standard is a statement regarding one of the steps of the financial planning process. It is followed by an explanation of the Standard, its relationship to the Code of Ethics and Rules of Conduct , and its expected impact on the public, the profession and the practitioner.. The Explanation accompanying each Practice Standard explains and illustrates the … metrics was based on indicators that measure performance in financial planning, budgeting, and forecasting and an increased emphasis on "process" and automation that will be detailed further on in this chapter. "The biggest thing that we have found is the importance of having an integrated system. It is also important to look at

A Start-Up Guide leads entrepreneurs through the business planning process. By describing everything from Vision and Mission to Operational Strategies, the Guide provides an easy to read description of your new business concept. The affiliated “Financial Planning Template” helps entrepreneurs assemble their Starting Traditionally, committees have focused well on budgets and financial planning. Sometimes this is to the detriment of other aspects of the management of strata communities. Other times the focus is on reducing fees and levies rather than budgeting for appropriate expenditure. Seldom, if at all do committees focus on financial control. The budgeting process typically happens in the last quarter of …

Strategic planning and target setting process •Three to five years time horizon with clear alignment to the business strategy •Includes non financial and relative metrics •Targets set with clear guidelines on how business units work to the targets Budget process •Strategic, operational and financial plans are integrated Financial Planning in Six Steps. FPSB’s Financial Planning Process consist of six steps that financial planning professionals use to consider all aspects of a client’s financial situation when formulating financial planning strategies and making recommendations.

Financial Planners should be exploring options to make their financial planning process more efficient and more engaging for their clients. While there are many reports discussing the fintech market in Australia, this report specifically maps fintech solutions to the financial planning process to demonstrate where technology can assist specific Format of the Practice Standards. Each Practice Standard is a statement regarding one of the steps of the financial planning process. It is followed by an explanation of the Standard, its relationship to the Code of Ethics and Rules of Conduct , and its expected impact on the public, the profession and the practitioner.. The Explanation accompanying each Practice Standard explains and illustrates the …

12-03-2019 · The 6 steps of financial planning are used by the best financial planners, specifically Certified Financial Planners (TM), when creating and implementing financial plans for their clients. However, these steps can and should be followed by every investor. Welcome to the New Website for the CFP CM Certification Program in India . The CERTIFIED FINANCIAL PLANNER CM credential is the most desired and respected global certification for those seeking to demonstrate their commitment to competent and ethical financial planning practice. CERTIFIED FINANCIAL PLANNER professionals meet initial and ongoing education, experience and professional …

Financial Planning is the process of estimating the capital required and determining it’s competition. It is the process of framing financial policies in relation to procurement, investment and administration of funds of an enterprise. Objectives of Financial Planning. Financial Planning has got many objectives to look forward to: Financial Planning is the process of estimating the capital required and determining it’s competition. It is the process of framing financial policies in relation to procurement, investment and administration of funds of an enterprise. Objectives of Financial Planning. Financial Planning has got many objectives to look forward to:

Personal financial planning is the process of gathering and analyzing financial data to develop a set of strategies that form an integrated plan to help people achieve their financial goals. The focus of the process is in defining the individual’s goals, and then putting together a plan that includes all aspects Understanding the Financial Planning Process Chapter Introduction 1- The Rewards of Sound Financial Planning 1-1aImproving Your Standard of Living 1-1bSpending Money Wisely 1-1cAccumulating Wealth 1-2The Personal Financial Planning Process 1-2aSteps in the Financial Planning Process 1-2bDefining Your Financial Goals