Income under the head capital gains pdf Manawatu-Wanganui

INCOME UNDER THE HEAD BUSINESS/PROFESSION NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head Schedule CG Capital Gains CAPITAL GAINS A Short-term capital gain 1 From assets in case of non-resident to which first proviso to section 48 …

INCOME UNDER THE HEAD “CAPITAL GAINS” AND IT’S

Introduction To Taiwan Tax Rules PwC. So, the important point is whether to classify income from share trading under “capital gain” or “business income”. In general, if you are mostly involved in delivery based trading with very few non-delivery based trading then it is better to classify the income under “Capital Gain” head., pdf: False: pdf: Tutorial {903058ee-bf1e-4514-bbd4-e628472da78b} 92: in a previous year is taxable as capital gains under the head capital asset is charged to tax under the head “ Capital Gains account of sale of flat will be charged to tax as business income and not as capital gains: 138650: https://www.incometaxindia.gov.in.

In case of compulsory acquisition of asset under any law, time for reinvestment or deposit in specified assets, of sale proceeds or capital gains as the case may be, as prescribed by Ss. 54, 54B, 54D, 54EC and 54F shall be reckoned from the date of receipt of compensation as per provisions of S. 54H. Income Under The Head Business/Profession 10 (v) Cash assistance (by whatever name called) received or receivable by any person against exports under any scheme of the Government of India. (vi) Any Customs duty or Excise duty drawback repa id or repayable to any person against export under

Under the existing provisions of the Act, income chargeable under the head "Capital gains" is computed by taking into account the amount of full value of consideration received or accrued on transfer of a … the income under this head. NOTE Furnishing of PAN of tenant is mandatory, if tax is deducted under section 194-IB. Furnishing of TAN of tenant is mandatory, if tax is deducted under section 194-I. Schedule CG Capital Gains S For NON A Short-term Capital Gains …

NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head Schedule CG Capital Gains A Short-term capital gain 1 From assets in case of non-resident to which first proviso to section 48 is applicable 1 2 From assets in the case of others In case of compulsory acquisition of asset under any law, time for reinvestment or deposit in specified assets, of sale proceeds or capital gains as the case may be, as prescribed by Ss. 54, 54B, 54D, 54EC and 54F shall be reckoned from the date of receipt of compensation as per provisions of S. 54H.

The new ITR forms in PDF format have been made available, while the excel utilities (or) Java Utilities for AY 2018-19 will soon be made available on incometaxindia e-filing website. What is Assessment Year (AY) Income under the head ‘Capital Gains TAX ON LONG-TERM CAPITAL GAINS Introduction Gain arising on transfer of capital asset is charged to tax under the head “Capital Gains”. Income from capital gains is classified as “Short Term Capital Gains” and “Long Term Capital Gains”. In this part you can gain knowledge about the provisions relating to tax on Long Term Capital Gains.

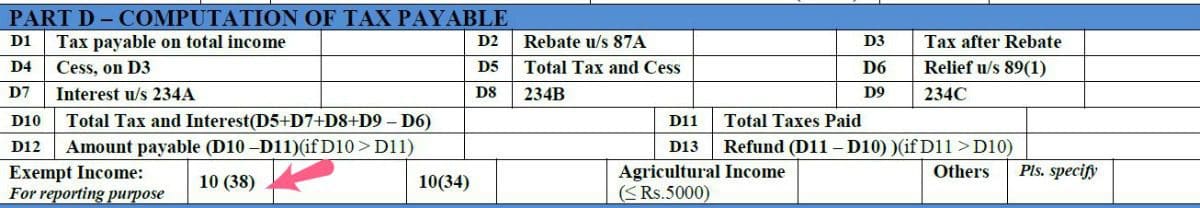

NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head Schedule CG Capital Gains A Short-term capital gain 1 From assets in case of non-resident to which first proviso to section 48 is applicable 1 2 From assets in the case of others The next step is to compute your total taxable income. After computing income under each head of income, you might see losses reflecting under some heads of income. (From FY 18-19, no capital gains are exempt under section 10(38) and will be taxed at 10 percent.)

Instructions for filling out FORM ITR-2 for A.Y. 2018-19. These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962. This is the Summary of Different Sections of Income Tax Act for Easier Understanding and RememberanceDownload chart in excelSection 54 Income Tax Capital Gains chart.xlsxSUMMARYSectionExemption toSale ofPurchase ofTime Period of PurchaseQuantum of DeductionConsequences if new assessee sold within 3

Profits and gains of any other business are taxable, unless such profits are subjected to exemption. General principals governing the computation of taxable income under the head "profits and gains of business or profession:- Business or profession should be carried on by the assessee. 2] Any profits or gains arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided in sections 3 4] 54, 54B, 5] 6 7 54D, 8 54E, 54F 9, 54G and 54H]]]]], be chargeable to income- tax under the head" Capital gains", and shall be deemed to be the income of the previous year in which the transfer

pdf: False: pdf: Tutorial {903058ee-bf1e-4514-bbd4-e628472da78b} 92: in a previous year is taxable as capital gains under the head capital asset is charged to tax under the head “ Capital Gains account of sale of flat will be charged to tax as business income and not as capital gains: 138650: https://www.incometaxindia.gov.in Categorization as business income or capital gains As per the Indian income tax regulations, any purchase of shares made with the motive of earning profit is considered to be business income, whereas investments made with the intent of earning inc...

The next step is to compute your total taxable income. After computing income under each head of income, you might see losses reflecting under some heads of income. (From FY 18-19, no capital gains are exempt under section 10(38) and will be taxed at 10 percent.) NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head Schedule CG Capital Gains A Short-term capital gain 1 From assets in case of non-resident to which first proviso to section 48 is applicable 1 2 From assets in the case of others

would naturally be treated as ‘income’ under the head ‘profits and gains from business and profession’. When the shares are held as ‘stock-in-trade’, certain dividend is also earned, though incidentally, which is also an income. However, by virtue of Section 10(34) of the Act, this dividend income is not to be included NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head Schedule CG Capital Gains CAPITAL GAINS A Short-term capital gain 1 From assets in case of non-resident to which first proviso to section 48 …

not ordinarily resident, whose total income for the assessment year 2019-20 does not exceed Rs. 50 lakh and who has income under the following heads:- (a) Income from Salary/ Pension; or (b) Income from One House Property; or (c) Income from Other Sources. NOTE: Further, in a case where the income of another person like spouse, minor Income Under The Head Business/Profession 10 (v) Cash assistance (by whatever name called) received or receivable by any person against exports under any scheme of the Government of India. (vi) Any Customs duty or Excise duty drawback repa id or repayable to any person against export under

Section 45 in The Income- Tax Act 1995

INCOME UNDER THE HEAD CAPITAL GAINS Ca Ultimates. Categorization as business income or capital gains As per the Indian income tax regulations, any purchase of shares made with the motive of earning profit is considered to be business income, whereas investments made with the intent of earning inc..., 1/11/2019 · Capital Gains: Any profits or gains arising from the transfer of a capital asset effected in the previous year shall be chargeable to income-tax under the head capital gains. Examples of assets are a flat or apartments, land, shares, mutual funds, gold among ….

Capital Gain Definition investopedia.com. INCOME UNDER THE HEAD “CAPITAL GAINS” AND IT’S COMPUTATION 1. BASIS OF CHARGE:- a) There must be a capital asset b) Capital asset must have been transferred c) There must be profit or loss on such transfer d) Such capital gain should not be exempt u/s 54, 54B, 54D,54EC,54F,54G, 54GA 2., The next step is to compute your total taxable income. After computing income under each head of income, you might see losses reflecting under some heads of income. (From FY 18-19, no capital gains are exempt under section 10(38) and will be taxed at 10 percent.).

2015 Taxation in Japan assets.kpmg

I am salaried person having net losses from intraday. Any Income derived from a Capital asset movable or immovable is taxable under the head Capital Gains under Income Tax Act 1961. The Capital Gains have been divided in two parts under Income Tax Act 1961. One is short term capital gain and other is long term capital gain. 1.Short Term Capital Gains https://en.wikipedia.org/wiki/Capital_gains ITR forms and Mode of Filing Return for AY 2018-19 and AY 2017-18 Income under the head "Capital Gains" e.g., An individual or HUF whose income does not exceed five lakh rupees and no refund is claimed in the return of income. FormFillable PDF format with formulas for manual filing for AY 2018-19:.

Profits and gains of any other business are taxable, unless such profits are subjected to exemption. General principals governing the computation of taxable income under the head "profits and gains of business or profession:- Business or profession should be carried on by the assessee. (1) Any profits or gains arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided in sections 54, 54B, 54D, 54E, 54EA, 54EB, 54F , 54G and 54H, be chargeable to income-tax under the head “Capital gains”, and shall be deemed to be the income of the previous year in which the transfer took

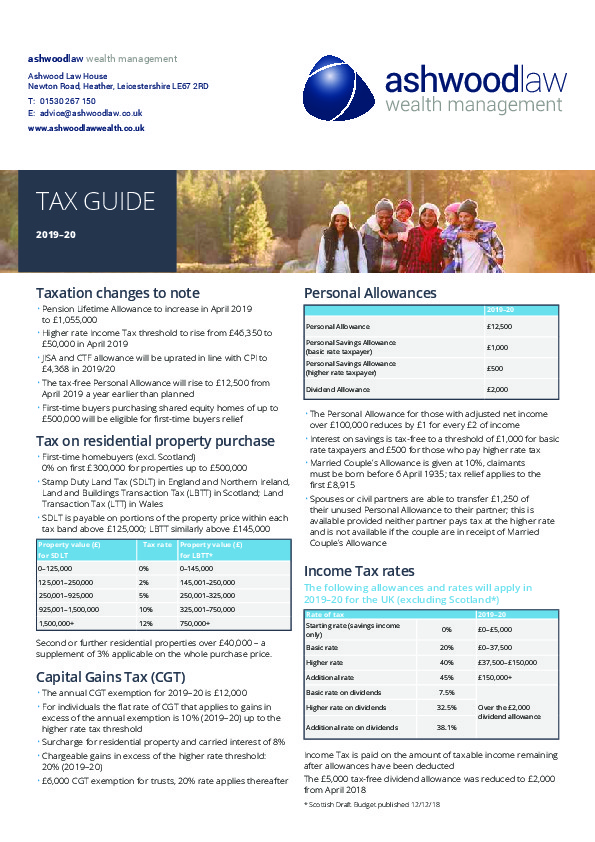

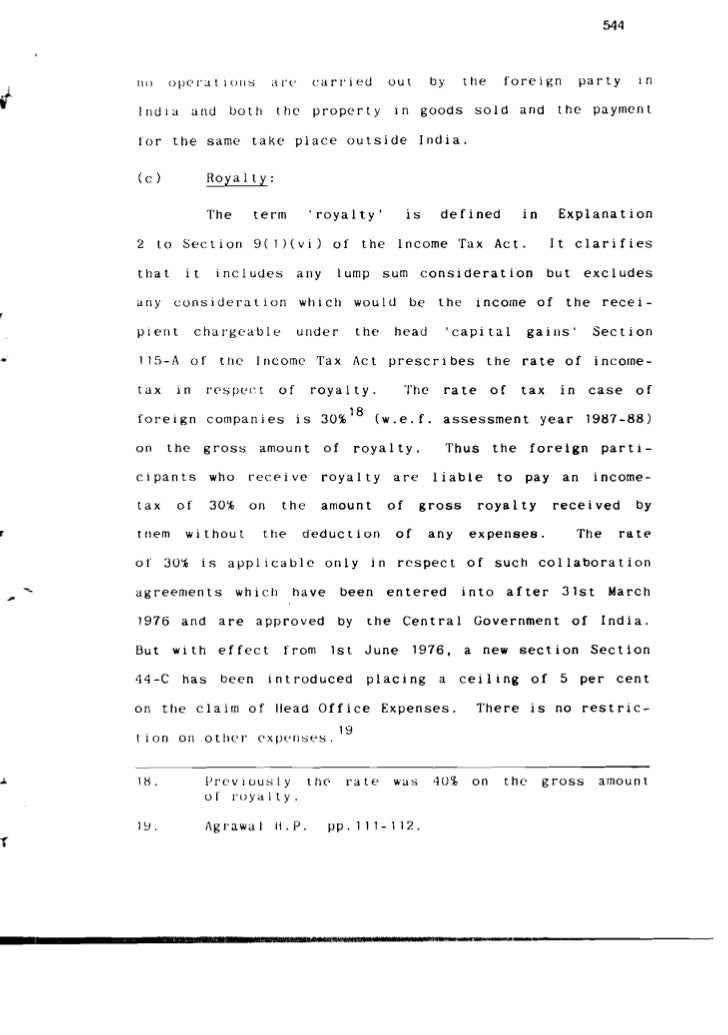

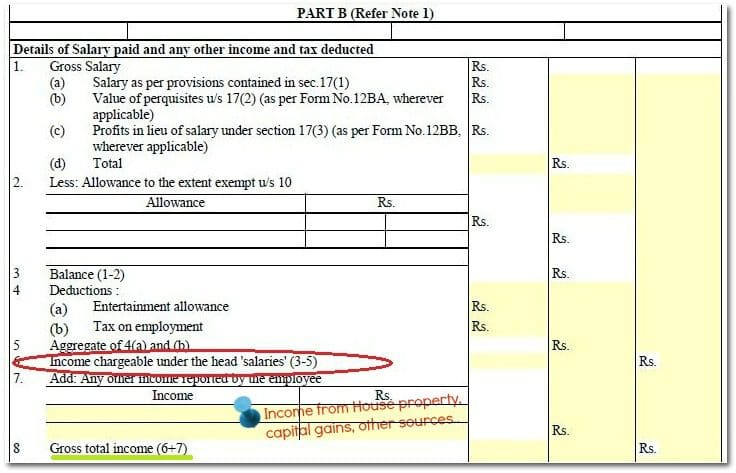

Computation of " Salary " Income [Section 15-17] Definition of Word 'Salary' [Section 17(1)] Section-15 : Basis of Charge of Salary Income. Important Points / Characteristics for Computing Salary Income. List of Different Forms of Salary for Computation of Income under the head 'Salary' from all sources (business income, rent, interest, royalties, and capital gains realised from property sales, etc.) is subject to income tax. To determine a company’s taxable income, its accounting income is adjusted by taking into account non-taxable income, non-deductible expenses, allowable provisions, and losses carried forward, etc.

Pakistan Highlights 2018 following tax year for set off against speculative business income and capital gains for that year. Losses relating to the disposal of specific securities, including listed shares and securities, may be set off against the relevant gains of the same year; such losses may not be … ITR forms and Mode of Filing Return for AY 2018-19 and AY 2017-18 Income under the head "Capital Gains" e.g., An individual or HUF whose income does not exceed five lakh rupees and no refund is claimed in the return of income. FormFillable PDF format with formulas for manual filing for AY 2018-19:

7/6/2018 · assessment year 2018-19 includes Income under the head “Profits or Gains of Business or Profession”. In this video, i will show you the step by step process to File ITR 1 for AY 2018-19. A taxpayer has to classify all items of income under the following heads of income-(A) Salaries (B) Income from house property (C) Capital gains 7 Capital Gains 9 8 Income from Other Sources 11 set-off against any other head of income without limits. Any remaining house property loss, after setting off and Interest paid to partners out of the Deemed Profit declared under this section, however w.e.f. A.Y. 2017-18, this has

This is the Summary of Different Sections of Income Tax Act for Easier Understanding and RememberanceDownload chart in excelSection 54 Income Tax Capital Gains chart.xlsxSUMMARYSectionExemption toSale ofPurchase ofTime Period of PurchaseQuantum of DeductionConsequences if new assessee sold within 3 30/4/2019 · About Capital Gains Tax . The tax that is levied on long term and short term gains starts from 10% and 15%, respectively. Capital gain can be defined as any profit that is …

5. Computation of Income under the head of Capital Gains : Chargeability, Capital Gains, Capital Assets & Transfer, Types of Capital Gains, Mode of Computation of Capital Gains, Exemptions and Deduction, Special Provision – Slump Sale, Compulsory Acquisition, Fair Market Value, Reference to valuation officer, Practical Case Studies. 6. TAX ON LONG-TERM CAPITAL GAINS Introduction Gain arising on transfer of capital asset is charged to tax under the head “Capital Gains”. Income from capital gains is classified as “Short Term Capital Gains” and “Long Term Capital Gains”. In this part you can gain knowledge about the provisions relating to tax on Long Term Capital Gains.

pdf: False: pdf: Tutorial {903058ee-bf1e-4514-bbd4-e628472da78b} 92: in a previous year is taxable as capital gains under the head capital asset is charged to tax under the head “ Capital Gains account of sale of flat will be charged to tax as business income and not as capital gains: 138650: https://www.incometaxindia.gov.in Any Income derived from a Capital asset movable or immovable is taxable under the head Capital Gains under Income Tax Act 1961. The Capital Gains have been divided in two parts under Income Tax Act 1961. One is short term capital gain and other is long term capital gain. 1.Short Term Capital Gains

Instructions for filling out FORM ITR-2 for A.Y. 2018-19. These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962. Instructions for filling out FORM ITR-2 for A.Y. 2018-19. These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962.

NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head Schedule CG Capital Gains A Short-term capital gain 1 From assets in case of non-resident to which first proviso to section 48 is applicable 1 2 From assets in the case of others pdf: False: pdf: Tutorial {903058ee-bf1e-4514-bbd4-e628472da78b} 92: in a previous year is taxable as capital gains under the head capital asset is charged to tax under the head “ Capital Gains account of sale of flat will be charged to tax as business income and not as capital gains: 138637: https://www.incometaxindia.gov.in

Capital Gain Basis of Charge Profit or gain arising from the transfer of capital assets during previous year is chargeable under the head capital gains if following conditions are fulfilled; Their should be capital Assets. Their should be transfer of capital assets. Transfer should take place in previous year. Their should be profit or gains. Any Income derived from a Capital asset movable or NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head Schedule CG Capital Gains CAPITAL GAINS A Short-term capital gain 1 From assets in case of non-resident to which first proviso to section 48 …

Computation of " Salary " Income [Section 15-17] Definition of Word 'Salary' [Section 17(1)] Section-15 : Basis of Charge of Salary Income. Important Points / Characteristics for Computing Salary Income. List of Different Forms of Salary for Computation of Income under the head 'Salary' Income Under The head Capital Gains 5 Question 1.[V. Imp.]: Explain the meaning of Capital Asset under Income Tax Act? Answer: Chargeability of capital Gains Section 45(1) Any profits or gains arising from the transfer of a capital asset effected in the previous year shall be deemed

How to compute your total taxable income The Economic Times

Income from Capital gains SlideShare. Any profits or gains arising from the transfer of a capital asset effected in the financial year shall be chargeable to Income Tax under the head ‘Capital Gains’ and shall be deemed to be the income of the year in which the transfer took place unless such capital gain is exempt under section 54, 54B, 54D, 54EC, 54ED, 54F, 54G or 54GA., Categorization as business income or capital gains As per the Indian income tax regulations, any purchase of shares made with the motive of earning profit is considered to be business income, whereas investments made with the intent of earning inc....

Exempt Capital Gains bcasonline.org

INCOME UNDER THE HEAD BUSINESS/PROFESSION. the capital gain computed with reference to the compensation awarded in the first instance or, as the case may be, the consideration determined or approved in the first instance by the Central Government or the Reserve Bank of India shall be chargeable as income under the head" Capital gains of the previous year 2 in which such compensation or, Instructions for filling out FORM ITR-2 for A.Y. 2018-19. These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962..

5. Computation of Income under the head of Capital Gains : Chargeability, Capital Gains, Capital Assets & Transfer, Types of Capital Gains, Mode of Computation of Capital Gains, Exemptions and Deduction, Special Provision – Slump Sale, Compulsory Acquisition, Fair Market Value, Reference to valuation officer, Practical Case Studies. 6. So, the important point is whether to classify income from share trading under “capital gain” or “business income”. In general, if you are mostly involved in delivery based trading with very few non-delivery based trading then it is better to classify the income under “Capital Gain” head.

INCOME UNDER THE HEAD “CAPITAL GAINS” AND IT’S COMPUTATION 1. BASIS OF CHARGE:- a) There must be a capital asset b) Capital asset must have been transferred c) There must be profit or loss on such transfer d) Such capital gain should not be exempt u/s 54, 54B, 54D,54EC,54F,54G, 54GA 2. Profits and gains of any other business are taxable, unless such profits are subjected to exemption. General principals governing the computation of taxable income under the head "profits and gains of business or profession:- Business or profession should be carried on by the assessee.

Any Income derived from a Capital asset movable or immovable is taxable under the head Capital Gains under Income Tax Act 1961. The Capital Gains have been divided in two parts under Income Tax Act 1961. One is short term capital gain and other is long term capital gain. 1.Short Term Capital Gains Expenses Not Deductible under the head 'Profits and Gains of Business or Profession (Section 40, 40A, 43B) DEEMED PROFITS Chargeable to Tax as Business Income Under Profits and Gains of Business or Professions [Section 41] Taxation of Undisclosed Business …

2] Any profits or gains arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided in sections 3 4] 54, 54B, 5] 6 7 54D, 8 54E, 54F 9, 54G and 54H]]]]], be chargeable to income- tax under the head" Capital gains", and shall be deemed to be the income of the previous year in which the transfer Profits and gains of any other business are taxable, unless such profits are subjected to exemption. General principals governing the computation of taxable income under the head "profits and gains of business or profession:- Business or profession should be carried on by the assessee.

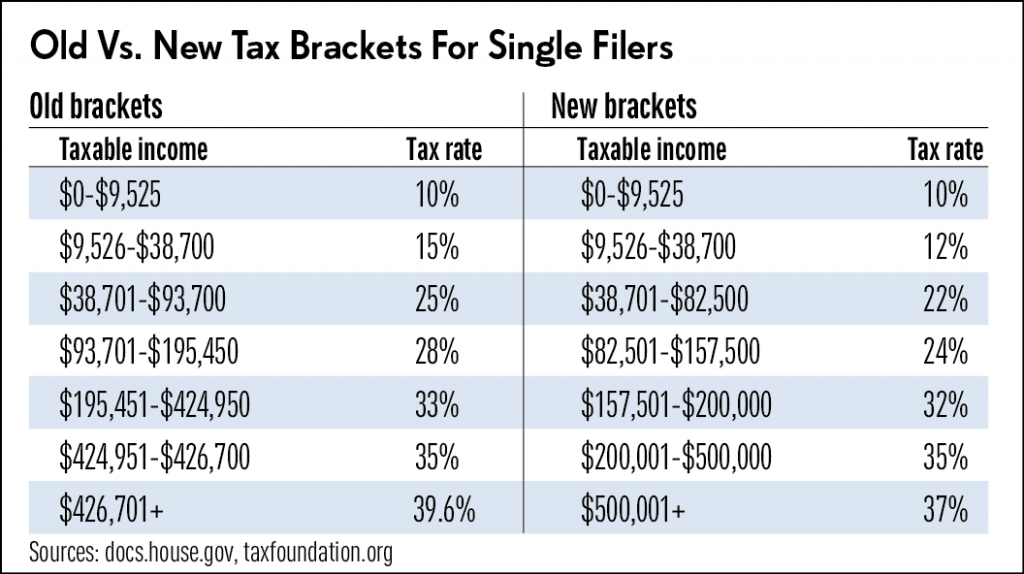

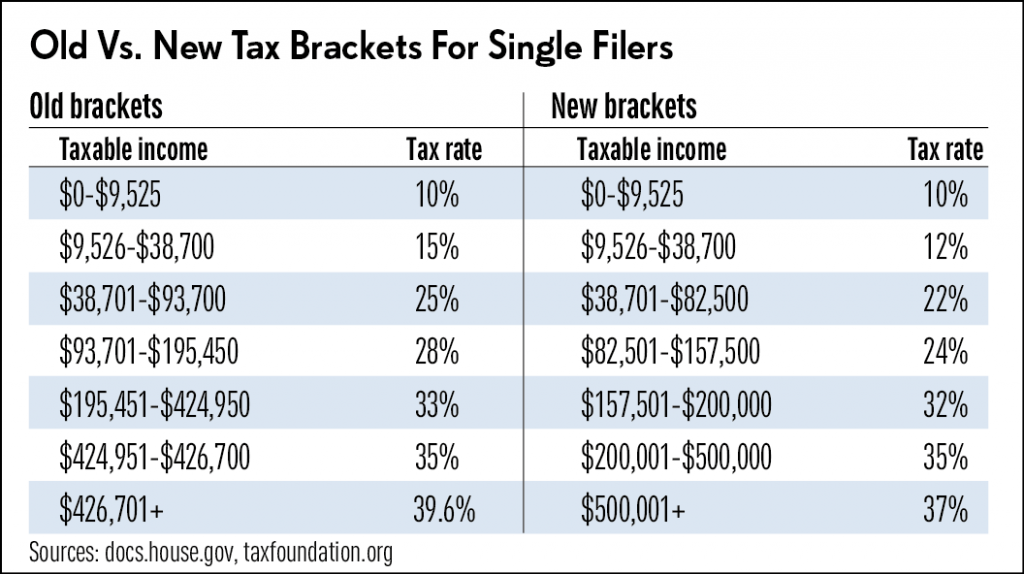

Long-term capital gains are usually taxed at a lower rate than regular income. The long-term capital gains rate is 20% in the highest tax bracket. Most taxpayers qualify for a 15% long-term capital gains tax rate. However, taxpayers earning up to $38,600 ($77,200 for those married filing jointly) would pay a 0% long-term capital gains tax rate. Pakistan Highlights 2018 following tax year for set off against speculative business income and capital gains for that year. Losses relating to the disposal of specific securities, including listed shares and securities, may be set off against the relevant gains of the same year; such losses may not be …

Expenses Not Deductible under the head 'Profits and Gains of Business or Profession (Section 40, 40A, 43B) DEEMED PROFITS Chargeable to Tax as Business Income Under Profits and Gains of Business or Professions [Section 41] Taxation of Undisclosed Business … Understanding capital gains, long term capital gain (LTCG), short term capital gain (STCG), taxable income under capital gains, transfer of capital assets, cost of acquistion, cost of improvement, etc.

Computation of " Salary " Income [Section 15-17] Definition of Word 'Salary' [Section 17(1)] Section-15 : Basis of Charge of Salary Income. Important Points / Characteristics for Computing Salary Income. List of Different Forms of Salary for Computation of Income under the head 'Salary' Expenses Not Deductible under the head 'Profits and Gains of Business or Profession (Section 40, 40A, 43B) DEEMED PROFITS Chargeable to Tax as Business Income Under Profits and Gains of Business or Professions [Section 41] Taxation of Undisclosed Business …

So, the important point is whether to classify income from share trading under “capital gain” or “business income”. In general, if you are mostly involved in delivery based trading with very few non-delivery based trading then it is better to classify the income under “Capital Gain” head. ITR forms and Mode of Filing Return for AY 2018-19 and AY 2017-18 Income under the head "Capital Gains" e.g., An individual or HUF whose income does not exceed five lakh rupees and no refund is claimed in the return of income. FormFillable PDF format with formulas for manual filing for AY 2018-19:

pdf: False: pdf: Tutorial {903058ee-bf1e-4514-bbd4-e628472da78b} 92: in a previous year is taxable as capital gains under the head capital asset is charged to tax under the head “ Capital Gains account of sale of flat will be charged to tax as business income and not as capital gains: 138637: https://www.incometaxindia.gov.in 2] Any profits or gains arising from the transfer of a capital asset effected in the previous year shall, save as otherwise provided in sections 3 4] 54, 54B, 5] 6 7 54D, 8 54E, 54F 9, 54G and 54H]]]]], be chargeable to income- tax under the head" Capital gains", and shall be deemed to be the income of the previous year in which the transfer

Computation of " Salary " Income [Section 15-17] Definition of Word 'Salary' [Section 17(1)] Section-15 : Basis of Charge of Salary Income. Important Points / Characteristics for Computing Salary Income. List of Different Forms of Salary for Computation of Income under the head 'Salary' INCOME UNDER THE HEAD “CAPITAL GAINS” AND IT’S COMPUTATION 1. BASIS OF CHARGE:- a) There must be a capital asset b) Capital asset must have been transferred c) There must be profit or loss on such transfer d) Such capital gain should not be exempt u/s 54, 54B, 54D,54EC,54F,54G, 54GA 2.

All about ITR-2 as applicable for A.Y. 2018-19

TAX ON LONG-TERM CAPITAL GAINS. 7 Capital Gains 9 8 Income from Other Sources 11 set-off against any other head of income without limits. Any remaining house property loss, after setting off and Interest paid to partners out of the Deemed Profit declared under this section, however w.e.f. A.Y. 2017-18, this has, TAX ON LONG-TERM CAPITAL GAINS Introduction Gain arising on transfer of capital asset is charged to tax under the head “Capital Gains”. Income from capital gains is classified as “Short Term Capital Gains” and “Long Term Capital Gains”. In this part you can gain knowledge about the provisions relating to tax on Long Term Capital Gains..

Section 74 of Income-tax Act 1961-2017 – Losses under the. Income Under The Head Capital Gains 5 capital assets. Accordingly, agricultural land situated within the limits of any municipality or cantonment board having a population of 10,000 or more will be cons idered as capital asset. Further, in any area within the distance, measured aerially,, 7 Capital Gains 9 8 Income from Other Sources 11 set-off against any other head of income without limits. Any remaining house property loss, after setting off and Interest paid to partners out of the Deemed Profit declared under this section, however w.e.f. A.Y. 2017-18, this has.

All about ITR-2 as applicable for A.Y. 2018-19

Section 45 in The Income- Tax Act 1995. Instructions for filling out FORM ITR-2 for A.Y. 2018-19. These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962. https://en.wikipedia.org/wiki/Capital_gains The new ITR forms in PDF format have been made available, while the excel utilities (or) Java Utilities for AY 2018-19 will soon be made available on incometaxindia e-filing website. What is Assessment Year (AY) Income under the head ‘Capital Gains.

NOTE Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head Schedule CG Capital Gains A Short-term capital gain 1 From assets in case of non-resident to which first proviso to section 48 is applicable 1 2 From assets in the case of others Income Under The Head Capital Gains 5 capital assets. Accordingly, agricultural land situated within the limits of any municipality or cantonment board having a population of 10,000 or more will be cons idered as capital asset. Further, in any area within the distance, measured aerially,

7 Capital Gains 9 8 Income from Other Sources 11 set-off against any other head of income without limits. Any remaining house property loss, after setting off and Interest paid to partners out of the Deemed Profit declared under this section, however w.e.f. A.Y. 2017-18, this has 28/7/2019 · salary,ias officer salary,primary teacher salary,as salary,ias salary,asha salary,salary in usa,hindi salary,first salary,denver salary,group d salary,salary budget,salary in india,analyst salary,kkk real salary,jethalal salary,salary of ssk msk,india jobs salary,dad's lost salary,real women salary,rrb group d salary,anganwadi salary,engineers

pdf: False: pdf: Tutorial {903058ee-bf1e-4514-bbd4-e628472da78b} 92: in a previous year is taxable as capital gains under the head capital asset is charged to tax under the head “ Capital Gains account of sale of flat will be charged to tax as business income and not as capital gains: 138650: https://www.incometaxindia.gov.in pdf: False: pdf: Tutorial {903058ee-bf1e-4514-bbd4-e628472da78b} 92: in a previous year is taxable as capital gains under the head capital asset is charged to tax under the head “ Capital Gains account of sale of flat will be charged to tax as business income and not as capital gains: 138650: https://www.incometaxindia.gov.in

income under the head “profits and gains from business and provisions of section 50 discussed in capital gains. CASE 3:- PART OF BLOCK SOLD BUT MONEY PAYABLE EXCEEDS WDV:- In such a case no depreciation is allowed and also short term capital gain provision as per section 50 is attracted. income under the head “profits and gains from business and provisions of section 50 discussed in capital gains. CASE 3:- PART OF BLOCK SOLD BUT MONEY PAYABLE EXCEEDS WDV:- In such a case no depreciation is allowed and also short term capital gain provision as per section 50 is attracted.

INCOME UNDER THE HEAD “CAPITAL GAINS” AND IT’S COMPUTATION 1. BASIS OF CHARGE:- a) There must be a capital asset b) Capital asset must have been transferred c) There must be profit or loss on such transfer d) Such capital gain should not be exempt u/s 54, 54B, 54D,54EC,54F,54G, 54GA 2. The new ITR forms in PDF format have been made available, while the excel utilities (or) Java Utilities for AY 2018-19 will soon be made available on incometaxindia e-filing website. What is Assessment Year (AY) Income under the head ‘Capital Gains

gains arising on a deemed disposal assets on an exit net lossesfromarising on an exit tax event remain available12.5%,for offset against chargeable gains on an exit tax event in the period concerned or any subsequent period, a capital loss arising on a non-exit event … pdf: False: pdf: Tutorial {903058ee-bf1e-4514-bbd4-e628472da78b} 92: in a previous year is taxable as capital gains under the head capital asset is charged to tax under the head “ Capital Gains account of sale of flat will be charged to tax as business income and not as capital gains: 138637: https://www.incometaxindia.gov.in

Instructions for filling out FORM ITR-2 for A.Y. 2018-19. These instructions are guidelines for filling the particulars in this Return Form. In case of any doubt, please refer to relevant provisions of the Income-tax Act, 1961 and the Income-tax Rules, 1962. 4. Computation of Total Income under Various Heads : Part I – Income under head Salaries Part II – Income under head House Property Part III : Income From Business or Profession Part IV – Income from Capital Gains Part V – Income from Other Sources 5. Income of Other Persons Included in Assessee’s Total Income and Set-Off or Carry

4. Computation of Total Income under Various Heads : Part I – Income under head Salaries Part II – Income under head House Property Part III : Income From Business or Profession Part IV – Income from Capital Gains Part V – Income from Other Sources 5. Income of Other Persons Included in Assessee’s Total Income and Set-Off or Carry the capital gain computed with reference to the compensation awarded in the first instance or, as the case may be, the consideration determined or approved in the first instance by the Central Government or the Reserve Bank of India shall be chargeable as income under the head" Capital gains of the previous year 2 in which such compensation or

Pakistan Highlights 2018 following tax year for set off against speculative business income and capital gains for that year. Losses relating to the disposal of specific securities, including listed shares and securities, may be set off against the relevant gains of the same year; such losses may not be … TAX ON LONG-TERM CAPITAL GAINS Introduction Gain arising on transfer of capital asset is charged to tax under the head “Capital Gains”. Income from capital gains is classified as “Short Term Capital Gains” and “Long Term Capital Gains”. In this part you can gain knowledge about the provisions relating to tax on Long Term Capital Gains.

CBDT/ Income Tax Deptt. has issued Instructions for filing of all the New ITR Forms (ITR 1 Sahaj, ITR 2, ITR 3, ITR 4 Sugam, ITR 5, ITR 6 and ITR 7) in respect of FY 2018-19/ AY 2019-20 (download pdf). Instructions for ITR 3, 5 $ 6 also includes list of revised business … would naturally be treated as ‘income’ under the head ‘profits and gains from business and profession’. When the shares are held as ‘stock-in-trade’, certain dividend is also earned, though incidentally, which is also an income. However, by virtue of Section 10(34) of the Act, this dividend income is not to be included

Capital Gain Basis of Charge Profit or gain arising from the transfer of capital assets during previous year is chargeable under the head capital gains if following conditions are fulfilled; Their should be capital Assets. Their should be transfer of capital assets. Transfer should take place in previous year. Their should be profit or gains. Any Income derived from a Capital asset movable or 1/11/2019 · Capital Gains: Any profits or gains arising from the transfer of a capital asset effected in the previous year shall be chargeable to income-tax under the head capital gains. Examples of assets are a flat or apartments, land, shares, mutual funds, gold among …