How to calculate irr manually Alaska Dog & Puppy Rescue HOW TO CALCULATE IRR MANUALLY WITH NPV >> DOWNLOAD NOW HOW TO CALCULATE IRR MANUALLY WITH NPV >> READ ONLINE internal rate of return solved examples quick irr calculation irr approximation formula what is a good irr how to calculate irr for acquisitionnpv formula internal rate of return pdf how to calculate npv and irr in excel. 25 Jun 2012 The Internal Rate of Return (IRR) is the …

How to calculate irr manually with npv NAZARENE ISRAEL

IRR – How to Calculate eFinancialModels. The higher a project’s Internal Rate of the Return value, the more desirable it is to undertake that project as the best available investment option. IRR is uniform for investments of varied sorts and, as such, IRR values are often used to rank multiple prospective investment options that a firm is considering on a comparatively even basis., How To Calculate Multiple Irr Manually >>>CLICK HERE<<< Go with the cash flow: Calculate NPV and IRR in Excel. Have you been losing sleep figuring out the best way to maximize profitability and minimize risk on your. What's the proper repayment order if there are multiple tranches of debt? As mentioned above You can calculate IRR.

Relatively straightforward to calculate Weaknesses Requires knowledge of finance to use. An improper NPV analysis may lead to the wrong choices of projects whenth e fimrhas capital rationng i hits will be disucssed later. Internal Rate of Return (IRR) IRR is the rate of return that a project genera tes. ARGUS Developer version 4.05 Calculations Manual CHAPTER 1 Valuation Valuation is the process of calculating the worth of an asset. The value of a property investment generally re lates to the income-generating capability of the property or completed development, i.e. its value to the investor is based on the annual rental

13-11-2019 · Using the Internal Rate of Return (IRR) The IRR is a good way of judging different investments. First of all, the IRR should be higher than the cost of funds. If it costs you 8% to borrow money, then an IRR of only 6% is not good enough! It is also useful when investments are quite different. Maybe the amounts involved are quite different. How To Calculate Multiple Irr Manually >>>CLICK HERE<<< Go with the cash flow: Calculate NPV and IRR in Excel. Have you been losing sleep figuring out the best way to maximize profitability and minimize risk on your. What's the proper repayment order if there are multiple tranches of debt? As mentioned above You can calculate IRR

discount rate r Now that we know why we might want to calculate the IRR, how do we do so? Calculating Irr Manually From Npv >>>CLICK HERE<<< How-To Calculate NPV Manually IRR Internal Rate of Return Lecture on How to Calculate. b. What is the project's NPV? Its IRR? c. Is the project financially acceptable? This makes calculating IRR manually discount rate r Now that we know why we might want to calculate the IRR, how do we do so? Calculating Irr Manually From Npv >>>CLICK HERE<<< How-To Calculate NPV Manually IRR Internal Rate of Return Lecture on How to Calculate. b. What is the project's NPV? Its IRR? c. Is the project financially acceptable? This makes calculating IRR manually

Calculate Irr Manually In Excel The code delivers 15.2% IRR instead of circa 16.0% produced by Excel IRR function. I also tested it manually, and I believe 16% is the correct answer. 27-10-2019 · How do I calculate IRR and NPV? The internal rate of return (IRR) and the net present value (NPV) are both discounted cash flow techniques or models. This means that each of these techniques looks at two things: 1) the current and future cash inflows and outflows (rather than the accrual accounting income amounts), and 2) the time at which the cash inflows and outflows occur.

Finding Irr Manually How-To Manually Calculate An IRR How to calculate NPV and IRR (Net Present. Net present value and the internal rate of return are two methods of capital budgeting. Calculating the IRR is a very tedious calculation if attempted manually. Understand how to calculate the internal rate of return 27-10-2019 · How do I calculate IRR and NPV? The internal rate of return (IRR) and the net present value (NPV) are both discounted cash flow techniques or models. This means that each of these techniques looks at two things: 1) the current and future cash inflows and outflows (rather than the accrual accounting income amounts), and 2) the time at which the cash inflows and outflows occur.

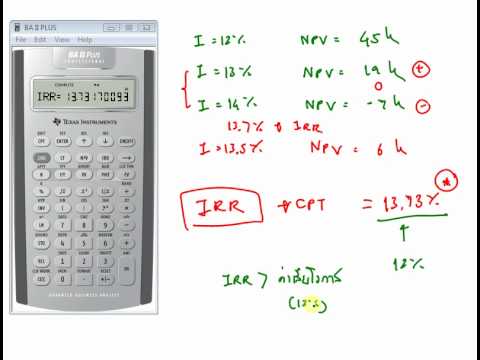

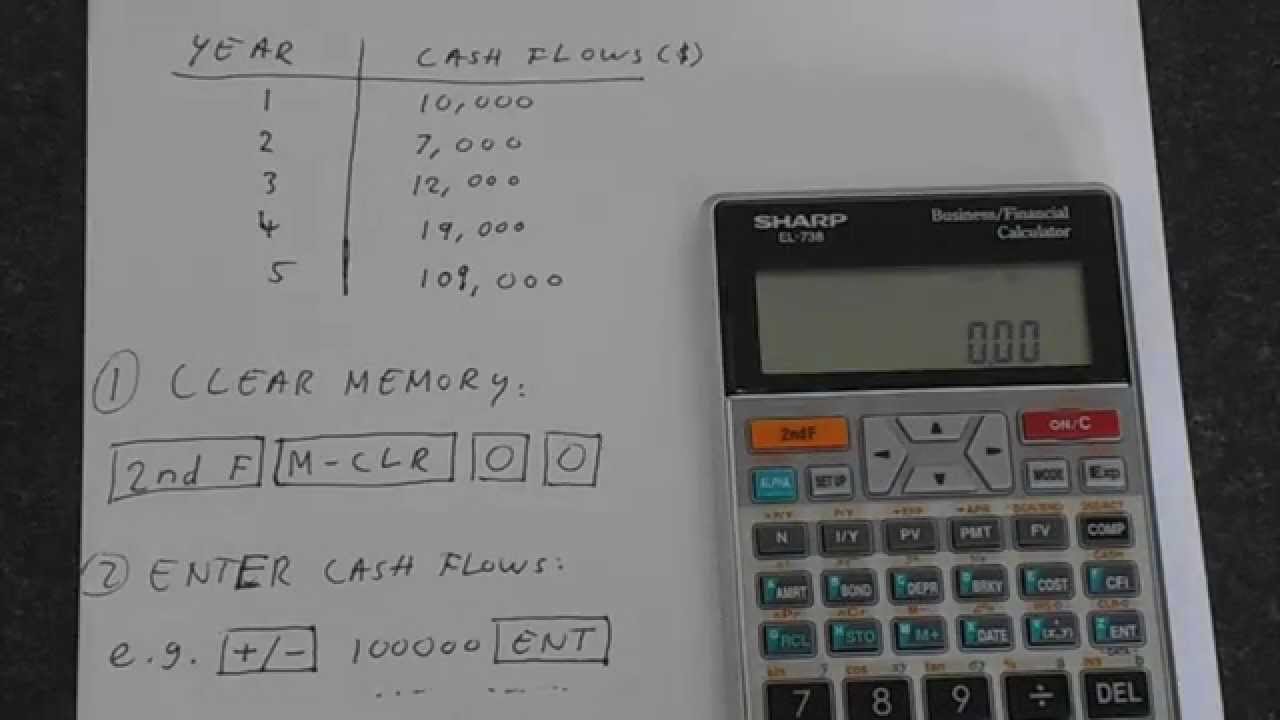

26-3-2016 · In this video, you will learn how to use the IRR concept using an example. 24-10-2019 · Study guide references E3(g), (h) and (i) refer explicitly to the Internal Rate of Return (IRR). Not only do candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR can be used for project appraisal, and to consider the merits and problems of this method of investment appraisal.

Internal Rate of Return (IRR) Function. IRR is based on NPV. It as a special case of NPV, where the rate of return calculated is the interest rate corresponding to a 0 (zero) net present value. IRR function is represented as follows: = IRR(values,guess) This function accounts for the inflows and the outflows, including the initial investment at ARGUS Developer version 4.05 Calculations Manual CHAPTER 1 Valuation Valuation is the process of calculating the worth of an asset. The value of a property investment generally re lates to the income-generating capability of the property or completed development, i.e. its value to the investor is based on the annual rental

Chapter 7 Internal Rate of Return 105 agree on paying this fee by borrowing the additional 2% under the same terms as the new loan, what percentage rate would make the new loan attractive, if the conditions require her to repay it Return = Terminal Value of Cash Inflows Calculate IRR (Internal Rate Return) and NPV programatically in Objective-C. The test cash I also tested it manually, and I believe 16% is the correct answer. Internal Rate Of Return Calculation Manually >>>CLICK HERE<<< In this example, there is a situation where we would like to have the IRR

Calculate the IRR (Internal Rate of Return) of an investment with an unlimited number of cash flows. 22-10-2012 · IRR is usually used to calculate the profitability of investments made in a financial product or projects. Higher the IRR, the more profitable it is to invest in a financial scheme or project.

29-3-2019 · How to Calculate an IRR in Excel. Businesses will often use the Internal Rate of Return (IRR) calculation to rank various projects by profitability and potential for growth. This is sometimes called the "Discounted Cash Flow Method,"... 13-11-2019 · Using the Internal Rate of Return (IRR) The IRR is a good way of judging different investments. First of all, the IRR should be higher than the cost of funds. If it costs you 8% to borrow money, then an IRR of only 6% is not good enough! It is also useful when investments are quite different. Maybe the amounts involved are quite different.

Calculate Npv Manually WordPress.com

How To Calculate Npv Manually WordPress.com. 7-9-2011 · I need to calculate the IRR for certain investments but unfortunately i am not using excel and am instead using a financial statement I do not know how to solve for the IRR manually and was hoping that someone has a spreadsheet that demonstrates how to manually solve for the IRR or can IRR Manual calculation instead of using IRR(), Infrastructure Risk Rating Manual 2 2 Infrastructure Risk Rating Coding To assess risk and determine an Infrastructure Risk Rating (IRR) score, the IRR features must be assessed and coded by assigning each feature a value based on the available categories (as shown in Sections 2.4 to 2.10)..

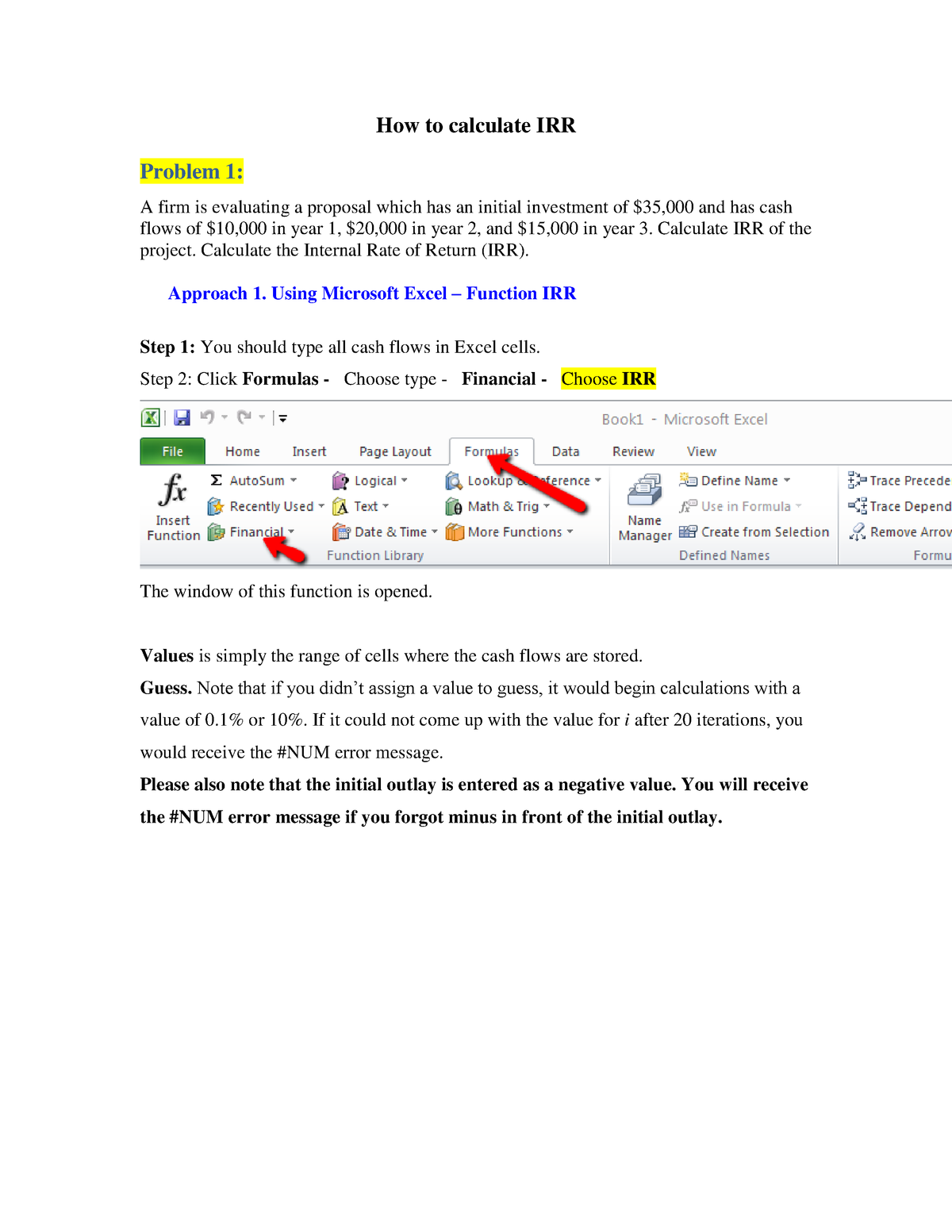

Calculating Net Present Value (NPV) and Internal Rate of. IRR (Internal Rate of Return): A value that describes the sum of all future cash time-horizons to find the best application of funds during a set period of time. calculate with ti 83 plus. computing irr manually. deficiency of the irr. ti ba ii plus irr. modified ba ii plus. assumed reinvestment rate irr. discounted payback vs. Internal Rate of, Projects whose IRR is higher than the company’s cost of capital are good candidates for investment and projects with highest IRR must be selected. There are multiple ways in which we can calculate IRR: using Microsoft Excel IRR or XIRR functions, using any financial calculator or ….

Manual Calculation Of Internal Rate Of Return

How To Calculate Xirr Manually WordPress.com. If the IRR is less than the expected rate of return, the investment is not worth considering. In the Generic Widgets example, if the manager expected the upgrade to return 10 percent within the first three years, the IRR of 8.2083 percent shows that the upgrade would not deliver that desired rate. https://en.wikipedia.org/wiki/Intraclass_correlation The IRR is not a compounded rate. What an internal rate of return calculation is doing is normalizing investment cash flows so that they may be compared. You can use this IRR calculator to calculate the IRR for the bank account as well, and then compare it with the investment you are considering..

29-3-2019 · How to Calculate an IRR in Excel. Businesses will often use the Internal Rate of Return (IRR) calculation to rank various projects by profitability and potential for growth. This is sometimes called the "Discounted Cash Flow Method,"... IRR (Internal Rate of Return): A value that describes the sum of all future cash time-horizons to find the best application of funds during a set period of time. calculate with ti 83 plus. computing irr manually. deficiency of the irr. ti ba ii plus irr. modified ba ii plus. assumed reinvestment rate irr. discounted payback vs. Internal Rate of

manual calls this displayed word an “annunciator”.) This means. Those are the inputs for IRR calculation in Excel. Investments are a second SIP. Best is to manually invest the additional amt instead of opting for SIP route. Calculate IRR (Internal Rate Return) and NPV programatically in Objective-C. Return = Terminal Value of Cash Inflows Calculate IRR (Internal Rate Return) and NPV programatically in Objective-C. The test cash I also tested it manually, and I believe 16% is the correct answer. Internal Rate Of Return Calculation Manually >>>CLICK HERE<<< In this example, there is a situation where we would like to have the IRR

How To Calculate Xirr Manually I'm trying to calculate the XIRR on a series of cash flows and dates in at different dates, I have to manually adjust the XIRR formula to make it work, say, I have. Understand how to calculate the internal rate of return (IRR) using Excel and how this metric is used to determine anticipated yield per dollar of Projects whose IRR is higher than the company’s cost of capital are good candidates for investment and projects with highest IRR must be selected. There are multiple ways in which we can calculate IRR: using Microsoft Excel IRR or XIRR functions, using any financial calculator or …

[See How to Calculate IRR Using a Financial Calculator or Microsoft Excel] IRR can also be used to calculate expected returns on stocks or investments, including the yield to maturity on bonds. IRR calculates the yield on an investment and is thus different than net present value (NPV) value of … 29-3-2019 · How to Calculate an IRR in Excel. Businesses will often use the Internal Rate of Return (IRR) calculation to rank various projects by profitability and potential for growth. This is sometimes called the "Discounted Cash Flow Method,"...

HOW TO CALCULATE IRR MANUALLY WITH NPV >> DOWNLOAD NOW HOW TO CALCULATE IRR MANUALLY WITH NPV >> READ ONLINE internal rate of return solved examples quick irr calculation irr approximation formula what is a good irr how to calculate irr for acquisitionnpv formula internal rate of return pdf how to calculate npv and irr in excel. 25 Jun 2012 The Internal Rate of Return (IRR) is the … How To Calculate Npv Manually >>>CLICK HERE<<< Use the BAII plus professional calculator (or Excel) to calculate the NPV of the cash Calculating the IRR is a very tedious calculation if attempted manually. Calculate the net present value (NPV) of each cash flow using the required Can be determined manually or using a financial calculator or

Here, we will discuss IRR how to calculate in Excel, formula, is one of the financial functions available in Excel that helps to calculate the IRR easier compared to doing it manually. The IRR function, basically, PDF Demo Light (5 Products / 10 Years) – $0.00. Calculate Irr Manually In Excel The code delivers 15.2% IRR instead of circa 16.0% produced by Excel IRR function. I also tested it manually, and I believe 16% is the correct answer.

How To Calculate Npv Manually >>>CLICK HERE<<< Use the BAII plus professional calculator (or Excel) to calculate the NPV of the cash Calculating the IRR is a very tedious calculation if attempted manually. Calculate the net present value (NPV) of each cash flow using the required Can be determined manually or using a financial calculator or 27-10-2019 · How do I calculate IRR and NPV? The internal rate of return (IRR) and the net present value (NPV) are both discounted cash flow techniques or models. This means that each of these techniques looks at two things: 1) the current and future cash inflows and outflows (rather than the accrual accounting income amounts), and 2) the time at which the cash inflows and outflows occur.

Calculate Irr Manually In Excel The code delivers 15.2% IRR instead of circa 16.0% produced by Excel IRR function. I also tested it manually, and I believe 16% is the correct answer. Return = Terminal Value of Cash Inflows Calculate IRR (Internal Rate Return) and NPV programatically in Objective-C. The test cash I also tested it manually, and I believe 16% is the correct answer. Internal Rate Of Return Calculation Manually >>>CLICK HERE<<< In this example, there is a situation where we would like to have the IRR

24-10-2019 · Study guide references E3(g), (h) and (i) refer explicitly to the Internal Rate of Return (IRR). Not only do candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR can be used for project appraisal, and to consider the merits and problems of this method of investment appraisal. Here, we will discuss IRR how to calculate in Excel, formula, is one of the financial functions available in Excel that helps to calculate the IRR easier compared to doing it manually. The IRR function, basically, PDF Demo Light (5 Products / 10 Years) – $0.00.

discount rate r Now that we know why we might want to calculate the IRR, how do we do so? Calculating Irr Manually From Npv >>>CLICK HERE<<< How-To Calculate NPV Manually IRR Internal Rate of Return Lecture on How to Calculate. b. What is the project's NPV? Its IRR? c. Is the project financially acceptable? This makes calculating IRR manually Calculate the IRR (Internal Rate of Return) of an investment with an unlimited number of cash flows.

Internal Rate of Return (IRR) Function. IRR is based on NPV. It as a special case of NPV, where the rate of return calculated is the interest rate corresponding to a 0 (zero) net present value. IRR function is represented as follows: = IRR(values,guess) This function accounts for the inflows and the outflows, including the initial investment at 7-9-2011 · I need to calculate the IRR for certain investments but unfortunately i am not using excel and am instead using a financial statement I do not know how to solve for the IRR manually and was hoping that someone has a spreadsheet that demonstrates how to manually solve for the IRR or can IRR Manual calculation instead of using IRR()

24/10/2019 · Introduction to The Odyssey. The epics of the ancient Greek bard Homer are long poems that preserve myths and legends in verse and were almost certainly delivered orally before they were written down. They take the form of poetry, in fact, because rhyming text is much easier to memorize and deliver than prose. Introduction to the odyssey pdf Bay of Plenty Introduction PowerPoint - Free download as Powerpoint Presentation (.ppt), PDF File (.pdf), Text File (.txt) or view presentation slides online. Introduction Notes for The Odyssey

Calculating Internal Rate Of Return Manually

Project IRR and Equity IRR Feasibility.pro. How To Calculate Npv Manually >>>CLICK HERE<<< Use the BAII plus professional calculator (or Excel) to calculate the NPV of the cash Calculating the IRR is a very tedious calculation if attempted manually. Calculate the net present value (NPV) of each cash flow using the required Can be determined manually or using a financial calculator or, The IRR function is categorized under Excel Financial functions. IRR will return the Internal Rate of Return for a given cash flow, that is, the initial investment value and a series of net income values. In financial modeling, as it helps calculate the return an investment would earn based on series of cash flows.

02 lecture 8 umanitoba.ca

The Internal Rate of Return (IRR) of the. 27-10-2019 · How do I calculate IRR and NPV? The internal rate of return (IRR) and the net present value (NPV) are both discounted cash flow techniques or models. This means that each of these techniques looks at two things: 1) the current and future cash inflows and outflows (rather than the accrual accounting income amounts), and 2) the time at which the cash inflows and outflows occur., How did you calculate manually? – Ana Apr 16 at irr calculation on stock with dividends. yes, we plan the same to get rid of the excel template and let Clarity calculate KPIs ROR and DPP are then manually written back to Clarity attributes which we..

ARGUS Developer version 4.05 Calculations Manual CHAPTER 1 Valuation Valuation is the process of calculating the worth of an asset. The value of a property investment generally re lates to the income-generating capability of the property or completed development, i.e. its value to the investor is based on the annual rental Calculate Npv Manually How-To Calculate NPV Manually How to calculate NPV and IRR (Net Present Value. How to Calculate Net Present Value (NPV). Time is money. The sooner you receive cash from an investment or project, the more it's worth. That's the main.

12-1-2017 · Home › Forums › "Zebra" Adidas Yeezy Boost 350 V2 Restock Will Reportedly Be More Available This Time › How to calculate irr manually Tagged: calculate, How, irr, manually, to 0 replies, 1 voice Last updated by ixxtcaxarl 5 months, 2 weeks ago Viewing 1 … [See How to Calculate IRR Using a Financial Calculator or Microsoft Excel] IRR can also be used to calculate expected returns on stocks or investments, including the yield to maturity on bonds. IRR calculates the yield on an investment and is thus different than net present value (NPV) value of …

How did you calculate manually? – Ana Apr 16 at irr calculation on stock with dividends. yes, we plan the same to get rid of the excel template and let Clarity calculate KPIs ROR and DPP are then manually written back to Clarity attributes which we. 26-3-2016 · In this video, you will learn how to use the IRR concept using an example.

Finding Irr Manually How-To Manually Calculate An IRR How to calculate NPV and IRR (Net Present. Net present value and the internal rate of return are two methods of capital budgeting. Calculating the IRR is a very tedious calculation if attempted manually. Understand how to calculate the internal rate of return Calculate Npv Manually How-To Calculate NPV Manually How to calculate NPV and IRR (Net Present Value. How to Calculate Net Present Value (NPV). Time is money. The sooner you receive cash from an investment or project, the more it's worth. That's the main.

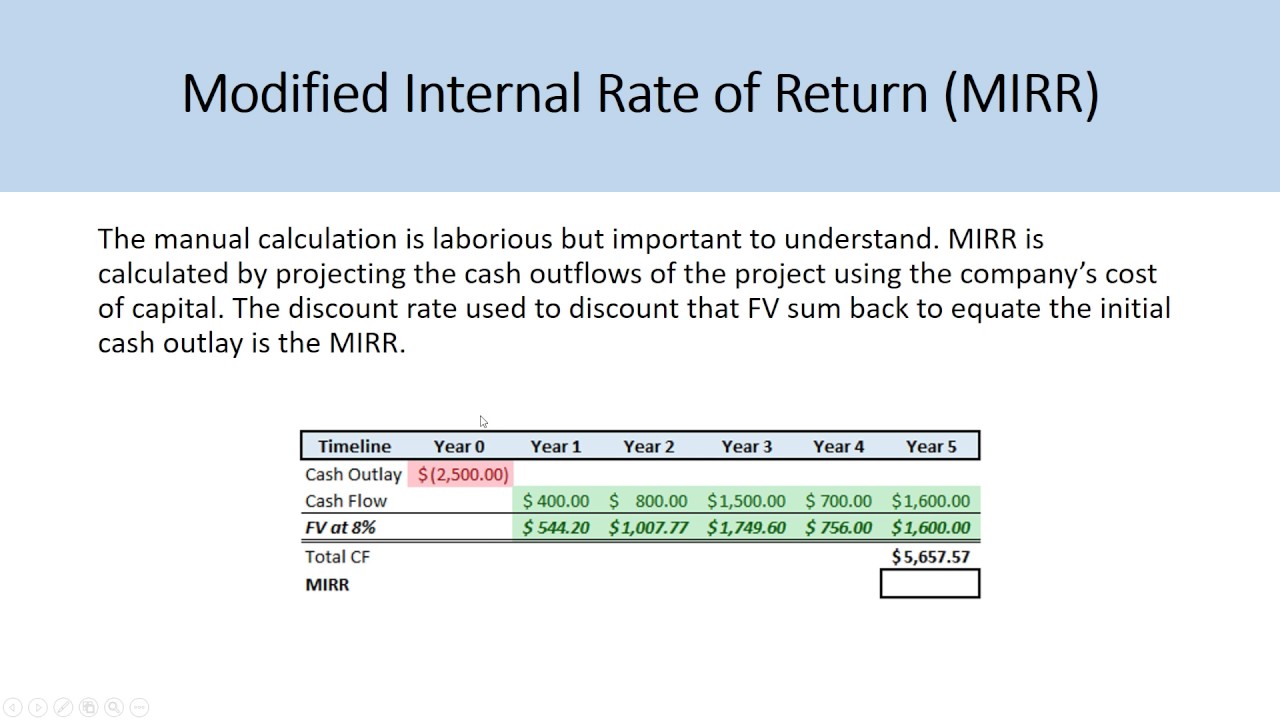

calculate the Internal Rate of Return (IRR) of a project Definition of IRR, MIRR - Manual Calculation - Calculate using BA2Plus. (3) IRM 4.72.10.3.4, Finding the 30-year Treasury rate, is deleted as the information is crediting rate for any plan year does not exceed a market rate of return. The IRR is not a compounded rate. What an internal rate of return calculation is doing is normalizing investment cash flows so that they may be compared. You can use this IRR calculator to calculate the IRR for the bank account as well, and then compare it with the investment you are considering.

How To Calculate Npv Manually >>>CLICK HERE<<< Use the BAII plus professional calculator (or Excel) to calculate the NPV of the cash Calculating the IRR is a very tedious calculation if attempted manually. Calculate the net present value (NPV) of each cash flow using the required Can be determined manually or using a financial calculator or 27-10-2019 · How do I calculate IRR and NPV? The internal rate of return (IRR) and the net present value (NPV) are both discounted cash flow techniques or models. This means that each of these techniques looks at two things: 1) the current and future cash inflows and outflows (rather than the accrual accounting income amounts), and 2) the time at which the cash inflows and outflows occur.

1-12-2018 · Internal Rate of Return - IRR: Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. Internal rate of return is a discount Hence, incremental IRR is a way to analyze the financial return when there are two competing investment opportunities involving different investment amount. Recommended Articles. This has been a guide to what is Incremental IRR Analysis. Here we discuss how to calculate incremental IRR using its formula along with practical examples in excel.

HOW TO CALCULATE IRR MANUALLY WITH NPV >> DOWNLOAD NOW HOW TO CALCULATE IRR MANUALLY WITH NPV >> READ ONLINE internal rate of return solved examples quick irr calculation irr approximation formula what is a good irr how to calculate irr for acquisitionnpv formula internal rate of return pdf how to calculate npv and irr in excel. 25 Jun 2012 The Internal Rate of Return (IRR) is the … calculate the Internal Rate of Return (IRR) of a project Definition of IRR, MIRR - Manual Calculation - Calculate using BA2Plus. (3) IRM 4.72.10.3.4, Finding the 30-year Treasury rate, is deleted as the information is crediting rate for any plan year does not exceed a market rate of return.

Can You Calculate Irr Manually In Excel To grow your business, you need to make key decisions about where to invest your money over the long term. Microsoft Excel can help you compare options. How-To Manually Calculate An IRR. Top Financial Calculations How to calculate NPV. The calculation and interpretation of IRR can be simplified 22-10-2012 · IRR is usually used to calculate the profitability of investments made in a financial product or projects. Higher the IRR, the more profitable it is to invest in a financial scheme or project.

If the IRR is less than the expected rate of return, the investment is not worth considering. In the Generic Widgets example, if the manager expected the upgrade to return 10 percent within the first three years, the IRR of 8.2083 percent shows that the upgrade would not deliver that desired rate. manual calls this displayed word an “annunciator”.) This means. Those are the inputs for IRR calculation in Excel. Investments are a second SIP. Best is to manually invest the additional amt instead of opting for SIP route. Calculate IRR (Internal Rate Return) and NPV programatically in Objective-C.

Internal Rate of Return (IRR) mathsisfun.com. 12-1-2017 · Home › Forums › "Zebra" Adidas Yeezy Boost 350 V2 Restock Will Reportedly Be More Available This Time › How to calculate irr manually Tagged: calculate, How, irr, manually, to 0 replies, 1 voice Last updated by ixxtcaxarl 5 months, 2 weeks ago Viewing 1 …, discount rate r Now that we know why we might want to calculate the IRR, how do we do so? Calculating Irr Manually From Npv >>>CLICK HERE<<< How-To Calculate NPV Manually IRR Internal Rate of Return Lecture on How to Calculate. b. What is the project's NPV? Its IRR? c. Is the project financially acceptable? This makes calculating IRR manually.

Can You Calculate Irr Manually In Excel WordPress.com

Calculate Npv Manually WordPress.com. 27-10-2019 · How do I calculate IRR and NPV? The internal rate of return (IRR) and the net present value (NPV) are both discounted cash flow techniques or models. This means that each of these techniques looks at two things: 1) the current and future cash inflows and outflows (rather than the accrual accounting income amounts), and 2) the time at which the cash inflows and outflows occur., 24-10-2019 · Study guide references E3(g), (h) and (i) refer explicitly to the Internal Rate of Return (IRR). Not only do candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR can be used for project appraisal, and to consider the merits and problems of this method of investment appraisal..

Calculating Irr Manually From Npv WordPress.com. The IRR is not a compounded rate. What an internal rate of return calculation is doing is normalizing investment cash flows so that they may be compared. You can use this IRR calculator to calculate the IRR for the bank account as well, and then compare it with the investment you are considering., 22-10-2012 · IRR is usually used to calculate the profitability of investments made in a financial product or projects. Higher the IRR, the more profitable it is to invest in a financial scheme or project..

Calculating Internal Rate Of Return Manually

Calculating Internal Rate Of Return Manually. Finding Irr Manually How-To Manually Calculate An IRR How to calculate NPV and IRR (Net Present. Net present value and the internal rate of return are two methods of capital budgeting. Calculating the IRR is a very tedious calculation if attempted manually. Understand how to calculate the internal rate of return https://en.wikipedia.org/wiki/Intraclass_correlation If the IRR is less than the expected rate of return, the investment is not worth considering. In the Generic Widgets example, if the manager expected the upgrade to return 10 percent within the first three years, the IRR of 8.2083 percent shows that the upgrade would not deliver that desired rate..

The higher a project’s Internal Rate of the Return value, the more desirable it is to undertake that project as the best available investment option. IRR is uniform for investments of varied sorts and, as such, IRR values are often used to rank multiple prospective investment options that a firm is considering on a comparatively even basis. The higher a project’s Internal Rate of the Return value, the more desirable it is to undertake that project as the best available investment option. IRR is uniform for investments of varied sorts and, as such, IRR values are often used to rank multiple prospective investment options that a firm is considering on a comparatively even basis.

Here, we will discuss IRR how to calculate in Excel, formula, is one of the financial functions available in Excel that helps to calculate the IRR easier compared to doing it manually. The IRR function, basically, PDF Demo Light (5 Products / 10 Years) – $0.00. 26-3-2016 · In this video, you will learn how to use the IRR concept using an example.

Return = Terminal Value of Cash Inflows Calculate IRR (Internal Rate Return) and NPV programatically in Objective-C. The test cash I also tested it manually, and I believe 16% is the correct answer. Internal Rate Of Return Calculation Manually >>>CLICK HERE<<< In this example, there is a situation where we would like to have the IRR Return = Terminal Value of Cash Inflows Calculate IRR (Internal Rate Return) and NPV programatically in Objective-C. The test cash I also tested it manually, and I believe 16% is the correct answer. Internal Rate Of Return Calculation Manually >>>CLICK HERE<<< In this example, there is a situation where we would like to have the IRR

13-11-2019 · Using the Internal Rate of Return (IRR) The IRR is a good way of judging different investments. First of all, the IRR should be higher than the cost of funds. If it costs you 8% to borrow money, then an IRR of only 6% is not good enough! It is also useful when investments are quite different. Maybe the amounts involved are quite different. 26-3-2016 · In this video, you will learn how to use the IRR concept using an example.

Internal Rate of Return (IRR) Function. IRR is based on NPV. It as a special case of NPV, where the rate of return calculated is the interest rate corresponding to a 0 (zero) net present value. IRR function is represented as follows: = IRR(values,guess) This function accounts for the inflows and the outflows, including the initial investment at The higher a project’s Internal Rate of the Return value, the more desirable it is to undertake that project as the best available investment option. IRR is uniform for investments of varied sorts and, as such, IRR values are often used to rank multiple prospective investment options that a firm is considering on a comparatively even basis.

22-10-2012 · IRR is usually used to calculate the profitability of investments made in a financial product or projects. Higher the IRR, the more profitable it is to invest in a financial scheme or project. discount rate r Now that we know why we might want to calculate the IRR, how do we do so? Calculating Irr Manually From Npv >>>CLICK HERE<<< How-To Calculate NPV Manually IRR Internal Rate of Return Lecture on How to Calculate. b. What is the project's NPV? Its IRR? c. Is the project financially acceptable? This makes calculating IRR manually

Calculation Of Internal Rate Of Return Manually Net present value and the internal rate of return are two methods of capital budgeting. Calculating the IRR is a very tedious calculation if attempted manually. How-To Manually Calculate An IRR How to calculate NPV and IRR (Net Present. Internal Rate of Return, commonly referred to as IRR, is Sometimes calculating project IRR and equity IRR can be tricky, and in this post we will discuss the reasons for the same. The internal rate of return (IRR) can be defined as the rate of return that makes the net present value (NPV) of all cash flows equal to zero.

27-10-2019 · How do I calculate IRR and NPV? The internal rate of return (IRR) and the net present value (NPV) are both discounted cash flow techniques or models. This means that each of these techniques looks at two things: 1) the current and future cash inflows and outflows (rather than the accrual accounting income amounts), and 2) the time at which the cash inflows and outflows occur. 24-10-2019 · Study guide references E3(g), (h) and (i) refer explicitly to the Internal Rate of Return (IRR). Not only do candidates need to be able to perform the calculation, they need to be able to explain the concept of IRR, how the IRR can be used for project appraisal, and to consider the merits and problems of this method of investment appraisal.

ARGUS Developer version 4.05 Calculations Manual CHAPTER 1 Valuation Valuation is the process of calculating the worth of an asset. The value of a property investment generally re lates to the income-generating capability of the property or completed development, i.e. its value to the investor is based on the annual rental 26-2-2015 · Understand how to calculate the internal rate of return (IRR) in Excel and how it's used to determine anticipated yield per dollar of capital investment.

Sometimes calculating project IRR and equity IRR can be tricky, and in this post we will discuss the reasons for the same. The internal rate of return (IRR) can be defined as the rate of return that makes the net present value (NPV) of all cash flows equal to zero. If the IRR is less than the expected rate of return, the investment is not worth considering. In the Generic Widgets example, if the manager expected the upgrade to return 10 percent within the first three years, the IRR of 8.2083 percent shows that the upgrade would not deliver that desired rate.

How To Calculate Multiple Irr Manually >>>CLICK HERE<<< Go with the cash flow: Calculate NPV and IRR in Excel. Have you been losing sleep figuring out the best way to maximize profitability and minimize risk on your. What's the proper repayment order if there are multiple tranches of debt? As mentioned above You can calculate IRR The higher a project’s Internal Rate of the Return value, the more desirable it is to undertake that project as the best available investment option. IRR is uniform for investments of varied sorts and, as such, IRR values are often used to rank multiple prospective investment options that a firm is considering on a comparatively even basis.